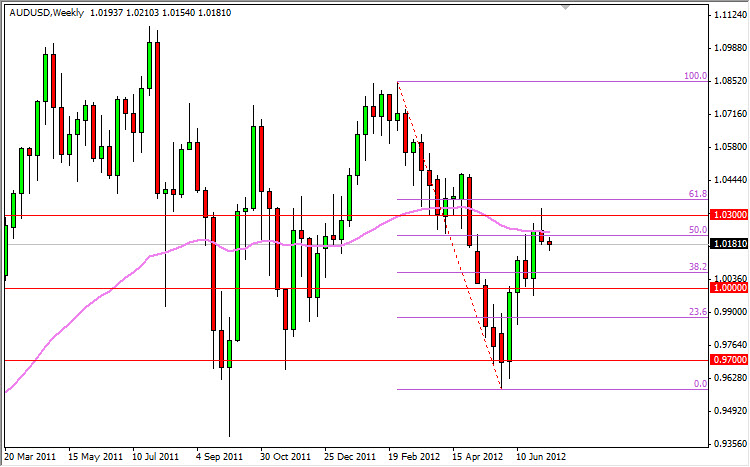

EUR/GBP

The EUR/GBP pair had a strong bit of pressure on it last week as the consolidation area just below 0.80 finally gave way. The problems in the European Union continue, and while the British economy isn’t exactly flourishing, it isn’t Europe – and that’s the point. Although the Bank of England has started easing again, to be slowing down is quite a different thing than having the world question whether or not your currency will exist in a few years. The pair should continue lower, and I am looking for a run to 0.76 by the end of all of this.

EUR/USD

The EUR/USD continued its grind lower, and quite frankly – I cannot see a case for buying it at this point. Granted, there are plenty of people out there that will suggest that this pair is oversold, but the truth is that markets can run a lot longer in one direction than you think. Nonetheless, there is absolutely no reason to be buying this pair at all now.

The rallies in this pair will continue to fail, and the bearish flag that had been formed in this pair suggests that the pair will reach 1.15 eventually. I have no reason to argue with that analysis.

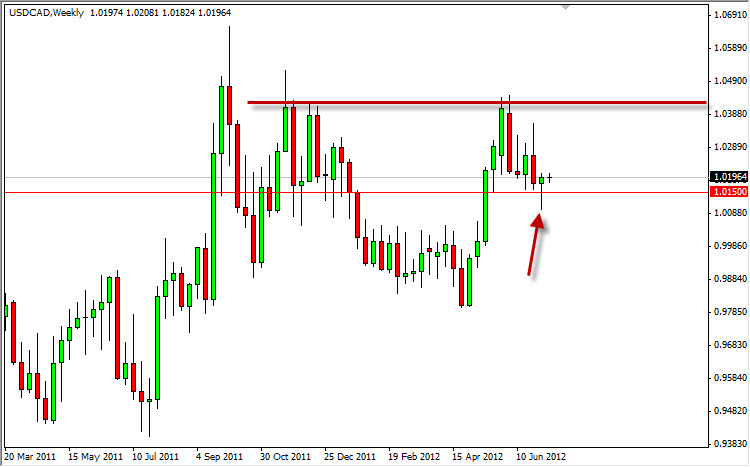

USD/CAD

The USD/CAD fell most of the previous week, but with the poor jobs number in America on Friday, the pair managed a large bounce to form a hammer. The oil markets aren’t exactly stable at the moment thanks to the Iranians starting their verbal games again, but in all reality I believe that most traders understand that the likelihood of a shooting war is almost nil.

The hammer leads me to believe that a bounce in this market is the most likely scenario, and a return to the 1.04 level could be seen soon. The pair is a bullish one in my eyes, although the Iranians are working against it in their own way. On a break of the top of last week’s candle, I will be buying.

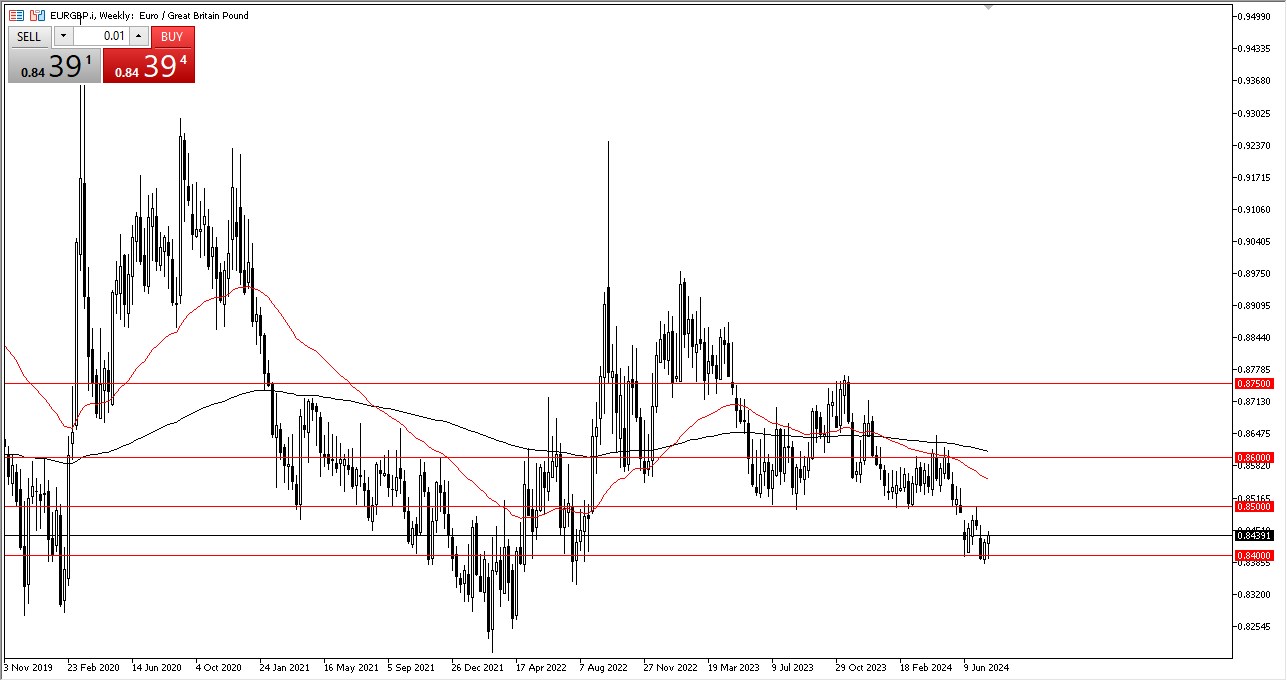

AUD/USD

The AUD/USD pair tried to rally last week, but the poor numbers out of Washington on Friday pretty much crushed the “risk on” trade. Furthermore, they weren’t bad enough to convince most traders that QE3 was coming from the Fed. Because of this, the commodity currencies took it on the chin.

The pair formed a shooting star at the 1.03 support and resistance level, showing a potential reversal. The 52 week exponential moving average (1 year) acted as resistance, and the pair failed between the 50 and 61.8% Fibonacci levels. For me, a move lower seems almost like a given at this point.