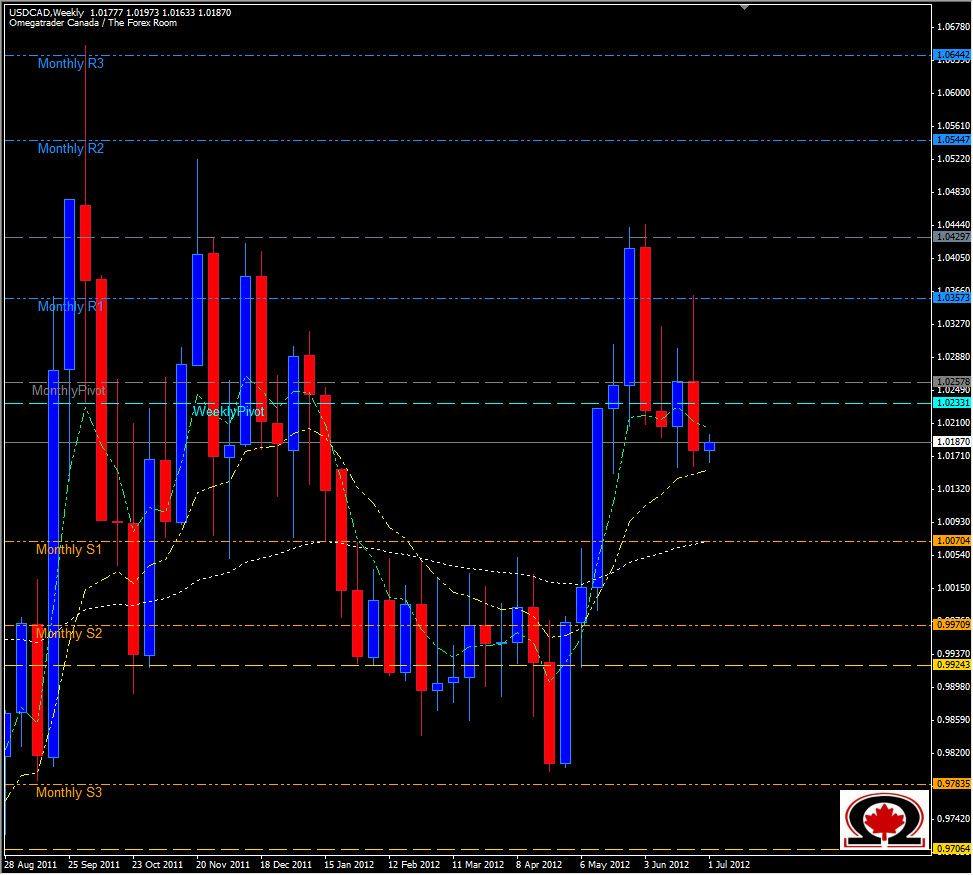

The US Dollar took a tumble last week due to slightly lower than expected economic numbers, as well as investors rushing back to the EURO after the now well known news from the EU Summit meetings. As a result, most currencies across the globe increased in value mirroring the decline in the USD. One currency to benefit from this is the Loonie, the Canadian Dollar. The Canadian Dollar rose to 1.0165 US before the market closed for the weekend, breaking an ascending trend-line on the Daily Chart and breaking Bearish out of a Bullish Flag formation on the same time frame. The pair came to a halt at the 62 EMA and has started to retrace during Asian Trading today, but it remains to be seen if the Bearish Trend will surface as the winner or if the Bulls will now resume the reigns and push the pair higher.

One argument in favor of the Bulls is another Bullish Flag pattern on the Weekly Chart, which hints at more Bullish sentiment in the bigger picture. With that said, the Weekly candle from last week is technically a Bearish Engulfing candle that may or may not over-ride the Bullish Flag on the same chart. The current low at 1.01595 will probably be the line in the sand for the week ahead, which any close below will be a good indication that prices will continue heading lower for the USD. However, the markets reaction to the EU Summit statements could have been only temporary and as traders, analysts and nations pick it apart in the days ahead the momentum may very well shift back to the upside for this pair and many others. Overall I am still bullish on this pair, but will wait for the higher volume markets in London and New York to open, before determining my short term bias...which will probably be Bearish.