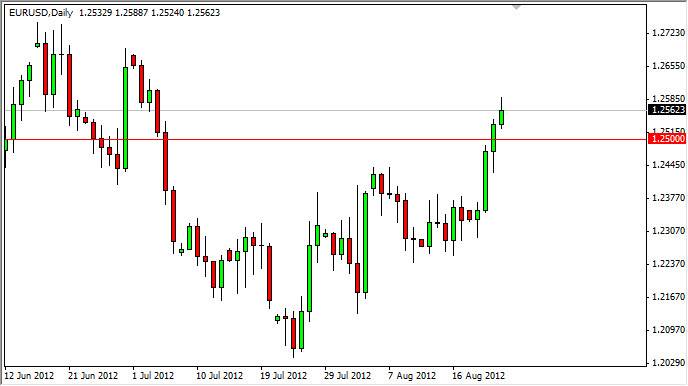

EUR/USD had another bullish session on Thursday as the short covering rally continues. The market has been rather impressive over the last several sessions, mainly based upon expectations of some type of Euro related bailout of Spanish banks. The truth is that once the move over the last several sessions has been a bit overdone, and we are still well within the tolerance of resistance that I have been watching.

Looking at the longer-term trend, it is certainly down and I do not want to go along of this pair. One of the biggest issues that you would have going long in this market is that you would have to short the US dollar. In an uncertain environment like we have right now, the US dollar will continue to be desirable overall. Also, there is real debate as to whether or not the Federal Reserve will do any type of monetary easing before the elections. If that is the case, the interest rate differential still remains fairly small.

There are numerous headline risks when it comes to owning the Euro, two of which are due for a conclusion on September 12. There are Dutch elections which could possibly throw some of the agreements into disarray and of course the German High Court decision on the constitutionality of the recent agreements in Europe. A poor result in either one of these variables could be potentially dangerous for the Euro itself.

Shooting star

The candle for Thursday is a bit of a shooting star, although it isn't a perfectly formed one. The body is a little bit bigger than we would want it to be, but it tells the same story: that perhaps the buying power is starting to wane a bit. Because of this, and the fact that it is in the middle of the massive resistance zone that runs from 1.24 to the 1.27 handle, it does look like we are about due for a pullback.

Market sentiment has been back and forth with the European Union over the last couple of years, and especially over the last several months. We have been bullish for a couple of weeks now, so certainly it is time to start selling again. On a break below the 1.25 level, I will be short of this market again. As for buying, I won't do it until we get above the 1.27 level as I would rather miss out on a good trade than buy into resistance.