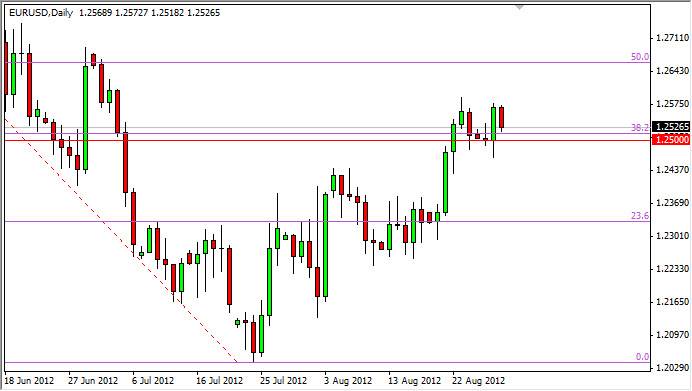

The EUR/USD pair pulled back during the Wednesday session as the Euro continues to consolidate right around the 1.25 level. This area is the beginning of massive resistance All the way to the 1.27 level, and as such it does look like the next 200 pips will be much more difficult than the last 200.

With Mr. Bernanke giving a speech at Jackson Hole on Friday, it appears that the markets are willing to consolidate until we get some type of clarity from the Chairman. It seems that the entire world is waiting with its hand out for the Federal Reserve to supply the "sugar" that the markets crave. After all, there is very little to be excited about as far as economic growth is concerned, and as such we need some type of artificial high in order to get the markets moving.

Because of this, I think that once the speeches given we should see some type of clarity in this pair. I personally believe that the headline risk is to the downside, as the markets are assuming that the Chairman will do what they want him to do. But what if he doesn't? If this were the case, this pair would absolutely fall apart in my opinion. After all, you have to remember that the European Central Bank absolutely has to ease its monetary policy as there are so many problems in the European Union currently.

1.27 Or 1.24

Personally, I see the 1.27 level giving way as a strong indication for buying this pair even though I see absolutely no reason to from a common sense standpoint. On the other hand, if we break down below the 1.24 level, I am more than willing to start selling this pair aggressively as it is with the trend. I think of Mr. Bernanke doesn't come through for the market; there's a real chance that this will happen. I know that personally for me, is much easier to take that trade than going long even if we do break above the 1.27 level. However, we must do what the markets tell us to as there is no point in fighting it.