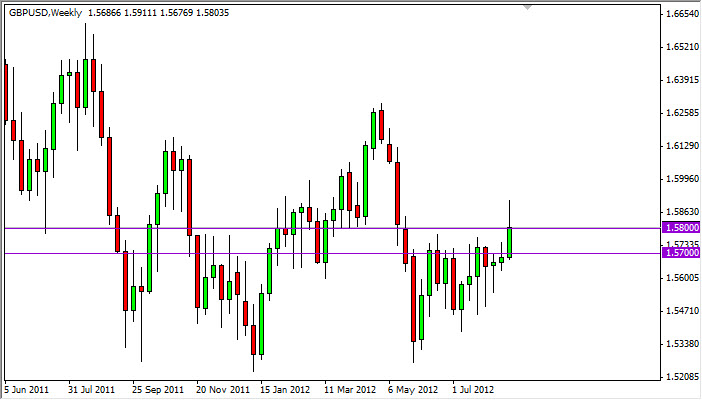

EUR/USD

The EUR/USD pair rose above the 1.25 level during the previous week, but pulled back on Friday to end the week on a sour note. The area that the pair is currently in is a big one, and I see resistance all the way up to the 1.27 which could be a problem for the buyers going forward. I do however see the possibility of shorting this pair if we close on the daily chart below the 1.25 handle.

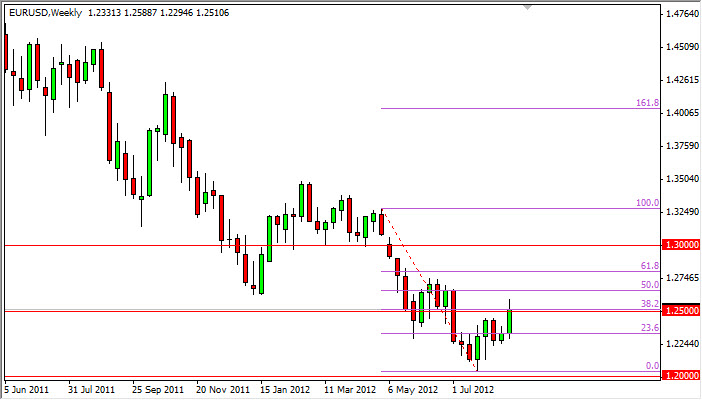

AUD/USD

The AUD/USD pair rallied for much of the week over the last five sessions, but ended the week looking very vulnerable. The resulting candle for the week was a shooting star. It should also be noted that the Friday session ended up closing below the uptrend line that has been guiding the market since early June. The 1.05 level now looks a bit too expensive for the Aussie, and the weak Chinese economic numbers lately certainly won’t be doing much to add confidence to the idea of commodity exports out of Australia.

Because of this, I think that we could see the 1.03 level tested for support in the near future. A break of the lows from the previous week would be a bearish sign, and if we can get below the 1.03 handle, the parity level looks likely.

EUR/GBP

The EUR/GBP pair rose during the last five sessions, but is currently facing real resistance above. The pair looks likely to try and get above the 0.80 level, but as the market is in such a massive downtrend, I think this area should more than likely keep prices down.

The Euro certainly has more than enough headwinds facing it, and the Pound has broken out lately. The fact is that the Bank of England is reportedly happy with the current monetary policy; there is a real chance that the European Central Bank will be forced to ease monetary policy in the near term. Because of this, it simply makes sense that this pair will offer selling opportunities once we get closer to the 0.80 level. It should also be noted that the pair is in a downtrend channel of sorts, and the 0.80 level seems to line up perfectly with the top of the channel as well.

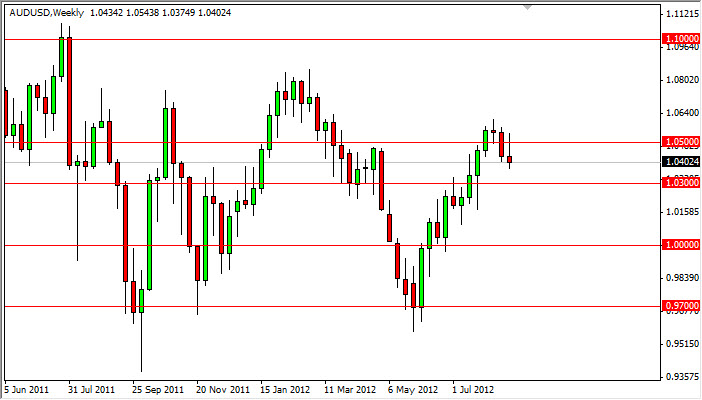

GBP/USD

The GBP pair broke out above the 1.58 level finally over the past week. However, I do have some concerns at this point. The pair fell back to the 1.58 level, and looks like it is trying to retest the area for support now. However, the daily chart closed at the very lows, and this isn’t a good sign typically.

If we can bounce from this area, then we have a real shot at getting up to the 1.63 level eventually. The area is the spot from which the sharp decline started in the beginning of summer, and as we look likely to see rates stay at currently levels in Britain it is possible that this pair will continue higher. After all, the Federal Reserve is thought to be easing monetary policy in September, and this should continue to push this pair higher. On the other hand, if the 1.57 level is broken to the downside – I would short this pair aggressively.