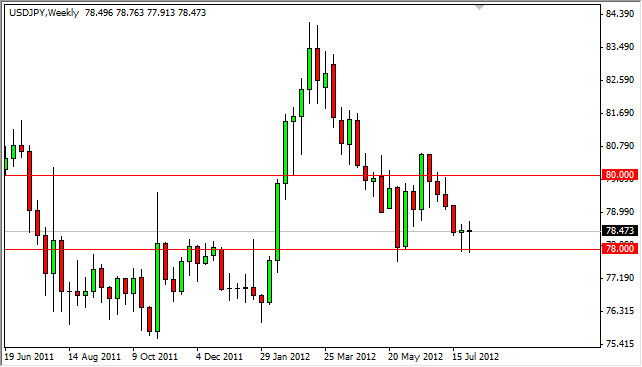

USD/JPY

The USD/JPY pair fell for much of the week as the 78 level continues to handle the bearish pressure quite well. I suspect that the Bank of Japan is under that level protecting the pair from falling too drastically. The main reason I say this is that they have already admitted to doing this previously, and write about at the same area. Also, it should be noted that the area is a massive support area based upon the resistive nature of it for the second half of 2011. I firmly believe that this is an area the Bank of Japan sees is about ground, and as such I think a break of the top of this hammer is an excellent signal to go long into we had at least 80, if not as high as 84 before it's all said and done. Selling is in an option as long as the central bank is working against the downside.

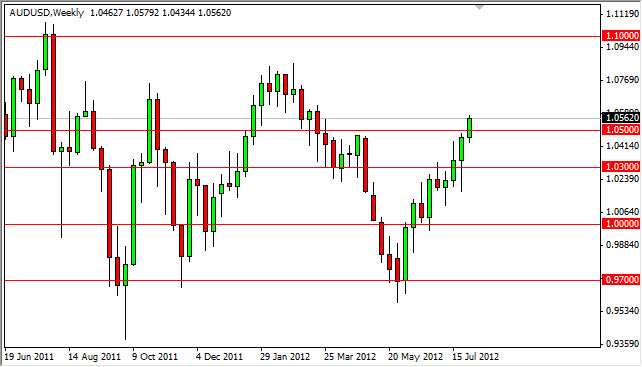

AUD/USD

The AUD/USD had a strong week over the last five sessions as the 1.05 level has finally been overcome. Although on the daily analysis I did suggest a pullback is coming, I think the overall trend is very clear in this pair as it has broken through several resistance areas. I think this is a pair that I will be buying on dips as I see value in it every time it pulls back.

My projected final target for this move is 1.08, and if we can get through that maybe even as high as 1.10 as it was the previous all-time high. Of course, there will be "risk off" sessions that will hurt the value this pair, but it's obvious that a lot of the traders out there believe easing is coming from several central banks, and if that's true the Australian dollar typically will do well in that environment.

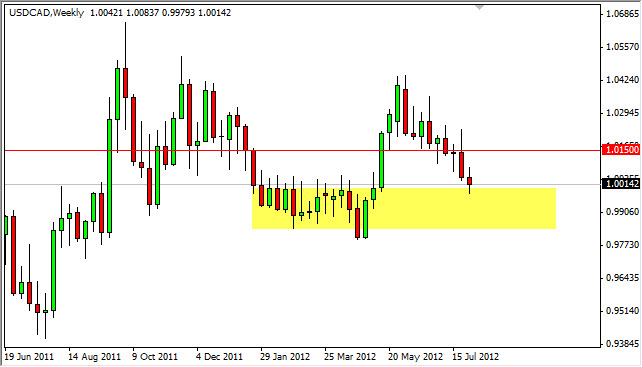

USD/CAD

USD/CAD has been an interesting trade lately, as it continues to grind lower even as the pressure seem to be building in both directions. However, this last week saw a very neutral looking candle, and it is sitting above the parity level which is acting as support. I believe the easiest trade will be to buy this pair if we can break the top of the candle from the previous week. This should send this pair looking for the 1.02 level, and possibly as high as 1.04 level.

However, it's obvious that there are a lot of sellers out there. I just don't see a clear path lower in till we get below the 0.98 handle. Once we get below that, there should be plenty of bearish momentum to take us down to 0.95 or even lower.

EUR/USD

The EUR/USD pair had one impressive bounce on Friday after the nonfarm payroll number came out. However, as you can see above the hammer that was formed for the week there is a lot of noise. I see the 1.25 level as a cluster of resistance. In fact, I see resistance all the way to the 1.20 area, and find this hard market to buy into.

The reality is that the Europeans are far from getting their act together, and as such any rally that comes along in this pair should be sold into. This looks like a bounce ready to happen, but it is hard to believe that all of a sudden the world is changed and we are already to buy Euros again. I am looking for some type of resistive candle near the 1.25 level in order to sell and may even use a daily candle in order to place a longer-term trade.