AUD/USD fell during the Monday session as volumes were a bit on the light side as the day went by. This is because of the United States celebrating the Labor Day holiday, and the fact that many of the North American firms would have been away from their desks.

The Australian dollar is highly connected with the Chinese economy. While this is been a strong and welcome thing over the last several years, there are starting to be report out of the mainland that perhaps China's economy isn't doing so well. Because of this, there will be a bit of concern when it comes to owning the Australian dollar. This makes sense of course, as the Chinese by most of their raw materials for large construction projects from the Aussies.

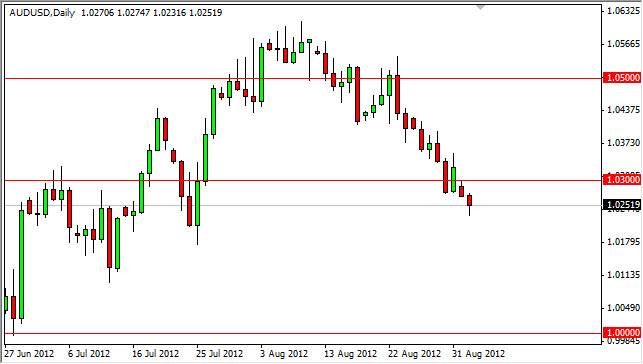

Looking at the charts, you can see that it has been a bit of a stunning fall from the 1.06 level just 30 days ago. This seems a bit extreme, but it must be said that the economic numbers out of China just keep getting worse. An up trending channel has been broken through to the downside, and the 1.03 level has given way as support.

Aiming for parity

Now that we have broken through the 1.03 level decisively, I believe that the next move is down to parity. Sure, there are a few minor support areas below current levels and above the parity handle, but in the end they will simply be speed bumps along the way.

I think that selling rallies at this point is the only way to trade this pair, and also expect the 1.03 area to remain significant in so much as it should be resistance now. On a rally that shows weakness in the form of a shooting star, bearish engulfing candle, or other type of formation, I would be more than willing to start selling the Australian dollar again. As for buying this pair, I do not see the reason to do so until we get above the 1.05 level.

One of the more interesting things that happened in this pair lately has been the fact that it fell fairly hard after an announcement by Chinese officials of an $800 billion stimulus package. It initially got the bomb that you would expect, but this was only short-lived. In fact, by the time three hours had passed, this pair fell. It is because of this that I believe the market is becoming more and more concerned about China, and this is the story that we will be talking about most of the fourth quarter this year.