The EUR/JPY pair had a fairly uneventful Monday, but this makes sense as the Americans were away on Labor Day. When you take that kind of liquidity out of the markets, big moves are necessarily in order. Because of this, it is very difficult to glean some type of technical analysis based upon just the Monday candle.

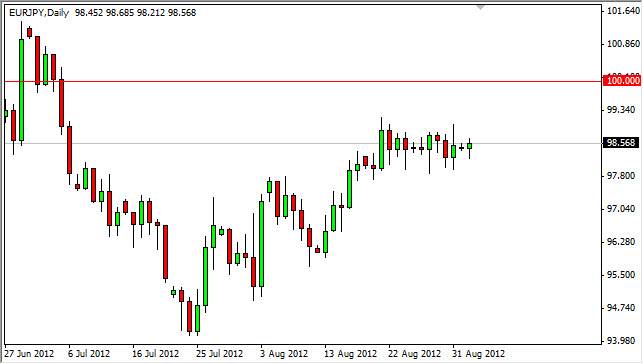

However, we are starting to see a pattern here that is very telling in my estimation. The 98 handle has shown quite a bit of support over the last two weeks, and in fact we have even printed a few hammers along the way. Granted, the Friday candle was a bit of a shooting star, and this of course would have the buyers a bit cautious at this point in time.

However, the tenacity of the bulls in this pair has been rather impressive. The pair simply refuses to fall, but then again it really can't gain any traction either. But why should it? After all, there is such uncertainty around the European Union at the moment.

Massive resistance zone

One of the biggest reasons this pair simply cannot rise can be seen in the area surrounding the 100 handle. Quite frankly, I believe that the 98 to the 101 level is one massive consolidation zone with a ton of sell orders sitting in it. While we have managed to break above the 98 handle, we are certainly struggling with the 99 level. I also see the 100 handle as important, mainly because of the psychological significance of that kind of number, and of course the historical reaction to it.

It isn't until we get to the 101 handle though that I feel resistance has been broken. Is because of this that I find this particular currency pair all that much more perplexing. While by many accounts, this pair looks very strong, the truth is there is still a lot of work to be done by the buyers. Because of this, I actually am waiting for a nice sell signal somewhere around the 100 handle. The main reason I did this analysis though, is to show that this pair could be a bit difficult to trade in the near term, even though it does look very well supported currently. As for me, I will look for that sell signal and take it when it shows up. If not, we could manage to break through the 101 handle and on a daily close above that level I will be long.