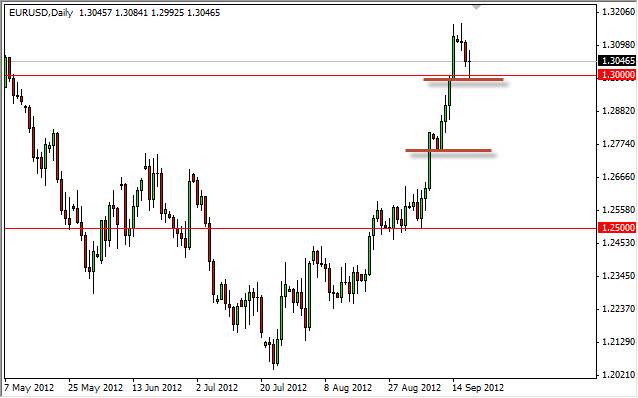

The EUR/USD pair fell for most of the session on Monday, but did bounce from the 1.30 level in order to form a hammer like candle. This suggests to me that perhaps we still have some bullish momentum going forward. I find this hard to believe, as we have simply been parabolic, but it does seem to be that currently this market is focusing solely on the Federal Reserve and its newfound quantitative easing.

The truth is that the European Union will have to start easing soon. Europe is in a recession in most countries, and the rest are following in short order. The European Central Bank has stated that it is willing to buy three-year bonds from any country that asks for assistance. This essentially means they are going to be printing Euros out of thin air, and this is always bad for currency.

In the meantime however, it does look like there is still momentum to the upside. I think it's going to be very difficult for the spare to get up over the 1.33 handle, but I have to admit I've been rather surprised so far. However, all you have to do is look at the velocity at which this pair has skyrocketed her last couple weeks to see that a pullback is desperately needed.

Still watching two levels

If the 1.30 doesn't hold as support, I think the 1.28 handle will be tested at that point. That area would be a much more comfy place to take a long position in the Euro from, and I would be much more willing to do so. I cannot stress enough how overbought this pair looks currently, and as such I am not willing to buying this market. Quite frankly, if I want to buy or sell the Euro, there are going to be easier currencies to match it up with.

Never forget, the Euro trades against several currencies, not just the Dollar. Because of this, I will look at this chart is a proxy for Euro strength, but may or may not be involved in this particular currency pair in the meantime. There are other currencies right now that are much more interesting like the Australian dollar, and if you can combine that with the Euro you can often have a much "cleaner" trade.