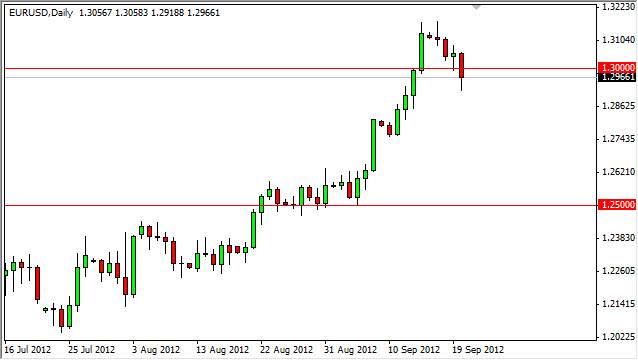

The EUR/USD pair fell during the session on Thursday as the 1.30 level couldn't hold the market up. This having said this, we are far from being able to call the Euro rally dead, as we are still certainly at lofty levels.

The market did give back some of its losses towards the end of the session, so there is some sign of life in the supportive sense just below the big figure handle, and as such it is very possible that we will pop back over the 1.30 level today.

It is well-known that I am not particularly Euro positive at the moment, but the truth is that the market is focusing more on the Federal Reserve than anything else currently. Is because of this that I feel this pair will continue to grind higher through the noise all the way up to the 1.33 level.

Two main levels

I still see the 1.30 and the 1.28 handles as the main levels to focus on currently. If we do manage to break down below the lows that were present on Thursday, I believe that the 1.28 handle will be the next target. However, as we solve bit of supportive action towards the end of the day it certainly wouldn't surprise me to see us bounce back up. After all, hope seems to burn eternal when it comes to the common currency.

I do believe ultimately we will start to fall again. This market is simply a matter of which side of the Atlantic is the trading community focusing on. In this particular strain of events, we have been paying more attention to the Federal Reserve and its actions than what's going on in Europe. There are some signs of a workout in Europe presently, but we are still a long way away from coming also type solution for the debt issue. In the near-term, the Euro should continue to rise in value. However, there are Greek elections coming up that could cause a lot of concerned. It will only be a matter of time before people start getting nervous about Europe again, and then we will start selling again.