By: DailyForex.com

EUR/USD

The EUR/USD pair fell during the week as the world continues to focus on all things Europe. The pair seems to have a bit of a weight on it as there are many reasons why the European Union can offer more headlines to move the market.

The market shows signs of support at the 1.2750 level, and I think this is where will see a bit of buying in the near term. The headline risks in this pair will more than likely keep it choppy in the near future. The 1.33 level above will more than likely be targeted before it is all said and done. However, the Euro can be bought against other currencies in order to gain from sudden bullish sentiment.

EUR/JPY

The EUR/JPY pair fell this past week, but unlike the EUR/USD pair, this market seems to have a much clearer path higher if we get going. This market looks like it could easily go back to the 105 level before it is all said and done, and I see the 99 handle as an area that the support goes down to. The next week will be vital, and if we can find support here – we could have a nice move. If 99 gives way, we will try the 95 handle to the downside.

AUD/USD

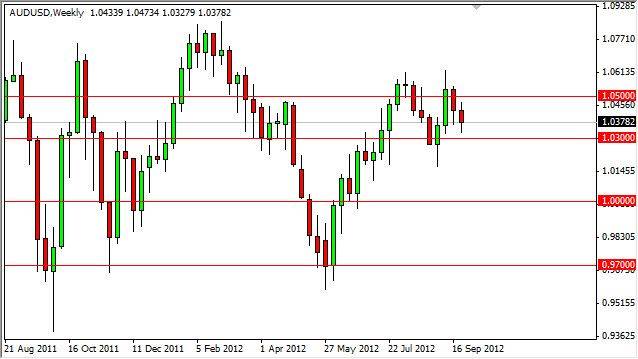

The AUD/USD pair will more than likely be a choppy market going forward. The Reserve Bank of Australia is expected to ease rates soon, but at the same time the Federal Reserve is printing unlimited amounts of Dollars. The weekly candle formed a pseudo hammer above the 1.03 level, and we will more than likely see an attempt to the 1.05 – 1.06 area.

As the gold markets rise, I think the AUD/USD will as well. It makes sense – there is a need for yield around the world, and in this low-yield environment, we could see a run to higher yielding currencies as a way in order to counter the lack of yields in the bond markets.

USD/CAD

This pair could be one of the more interesting ones in the near term. The Canadian dollar is of course influenced by the oil markets, and although they have fallen quite a bit lately – there are signs of serious support now. This should continue to pressure this pair to the downside, but the hammer from two weeks ago suggests supportive action in this market.

The 0.9950 level is an area that the buyers will struggle to get above. If the market does, there could be a run all the way back to the 1.04 level. (It was the top of the consolidation that the market had been in for months.) On the other side of this trade, if we can see oil rise, this pair could very well continue the downtrend that we have seen this year. A break well below the 0.98 handle on a daily close could see this pair falling as much as another 600 pips as this would be the implied measured move from the break of the consolidation.