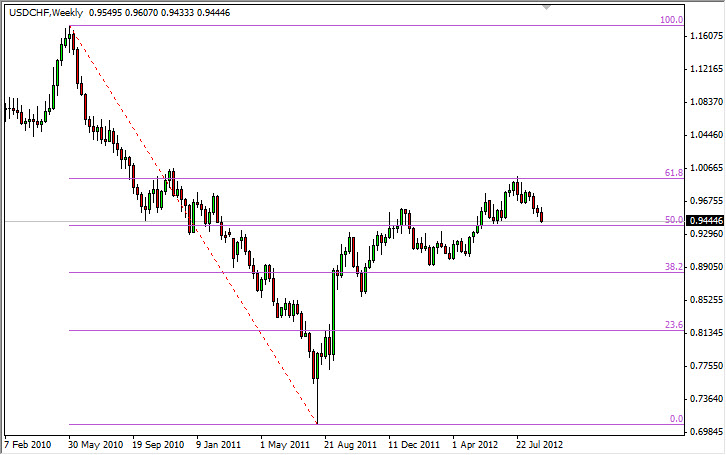

USD/CHF

The USD/CHF pair has pulled back from the 61.8% Fibonacci retracement level, and now sits just above the 50% level. The pair is trying the support level as the 0.95 – 0.94 area, and looks to continue lower.

Most of this is predicated upon the Federal Reserve and presumed quantitative easing, and as a result the Dollar overall is struggling. However, this area could provide a bounce. For myself, I believe that we will go lower if we can close below the 0.94 level on the daily close.

AUD/USD

The AUD/USD pair managed to bounce a bit this past week after the Friday session especially. The jobs number in America was very disappointing, and the possibility of the ECB stepping in and buying bonds in the region had traders in the “risk on” mode again. Now that we are over the 1.04 level, it looks very possible that we are going to see 1.05, and then 1.07 in the relatively near term.

GBP/USD

The GBP/USD pair shot straight up during the past week as the break out continues. The pair had been forming an ascending triangle over most of the summer, and now that the 1.58 has been cleared, there can be very little in the way of doubt when it comes to the bullishness of this pair.

The triangle measured for a move to the 1.63 level. There is absolutely nothing on this chart that says to me that the 1.63 handle can’t be reached. In fact, I am counting on it now that the Federal Reserve seems like it will have to ease. The currently level (1.60) could cause a bit of a pullback though, but this should only be an invitation to buy the Pound at lower prices.

USD/CAD

The USD/CAD pair has managed to break below and close sub-0.98. This is of course a bearish sign as it was the bottom of the massive range that the pair has been locked in for over a year. The last bit of resistance is being tested now, and as a result I think this pair will fall. If we get below the 0.9750 level – I am selling.