EUR/USD

The EUR/USD pair managed to jump over the 1.30 level, proving many analysts completely wrong – including yours truly. The pair is reacting I suggest waiting for pullbacks in order to go long of this pair. I do see potential for about another 200 to 300 extra pips going higher, but it is probably only a matter time before the market starts worrying about Europe again.

The 1.35 level will more than likely prove to be a bit strong for the buyers, and I believe by then we will see Europe back in the headlines. Nonetheless, in the meantime I suggest that many of the people that have missed this rally will be more than likely to get involved on signs of support after pullbacks. I even think the 1.30 may be supportive at this point. I'm even more impressed with a pullback to the 1.28 handle it shows support as it gives as much more room to run higher.

The USD/CAD pair had a positive day on Friday which is somewhat counterintuitive. In fact, this caused the weekly candle to be a hammer. With all the trouble in the Middle East, you would think that oil would've spiked miserably. However, by the end of the day there was talk about a possible release of the strategic petroleum reserve, and this could a bit of a cap on oil prices. This obviously had an effect on the Canadian dollar as well, as we formed a supportive hammer. It does look like the 0.97 level is going to put up a little bit of a fight, but I think eventually it gives way.

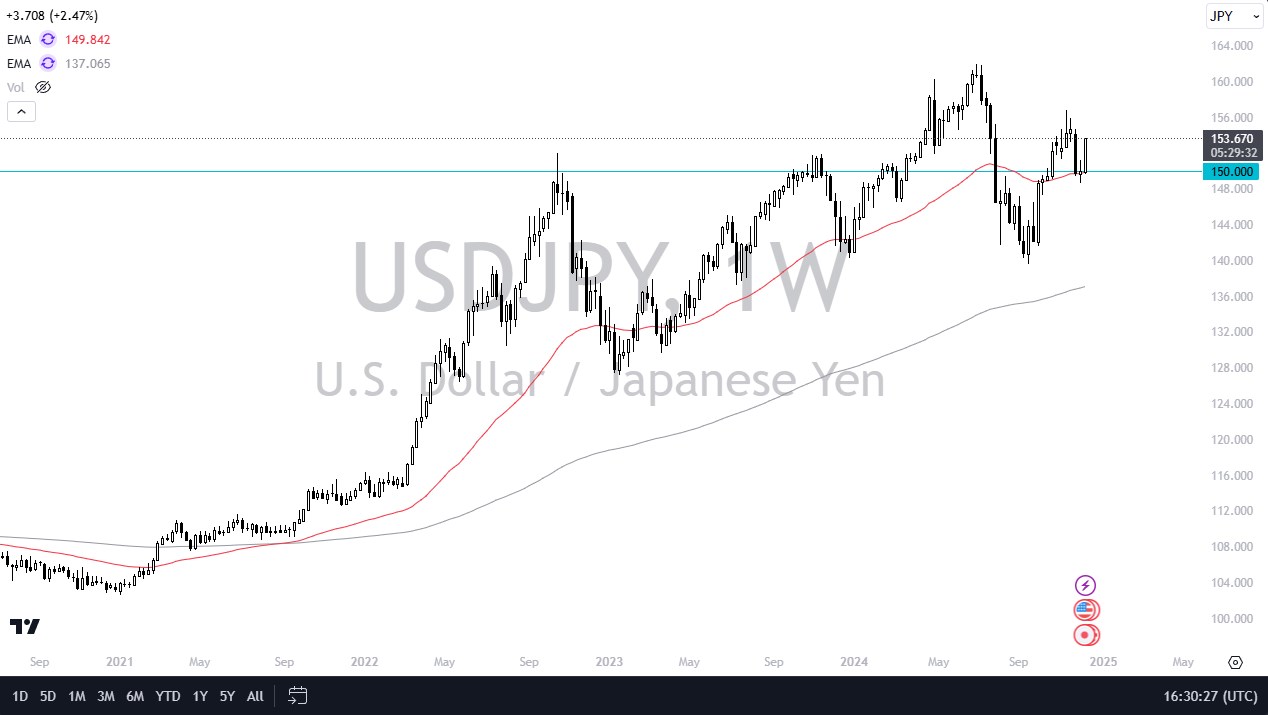

USD/JPY

The USD/JPY pair has been one of my fair wants to watch. We had an extremely volatile and erratic 48 hours at the end of the week, which resulted in a hammer right at the 78 handle. Because of this, I think that this pair will rise eventually and am buying on a break of the top of this previous week highs. Obviously, there is a ton of support below here and I think that selling is almost impossible. I think that 80 will end up being very resistive as well, so this is more of a short-term trade based off of a long-term chart.

GBP/USD

GBP/USD has been broken out for some time now, and this previous week was no different. I now see the 1.60 level as a bit of a floor in this market, and will be playing pullbacks as long as we can stay above that level.

Back during the summertime, we formed an ascending triangle that suggested we were going as high as 1.63 by the end of the move. I think that is selling the British pound a bit short as I think we will eventually go much higher.