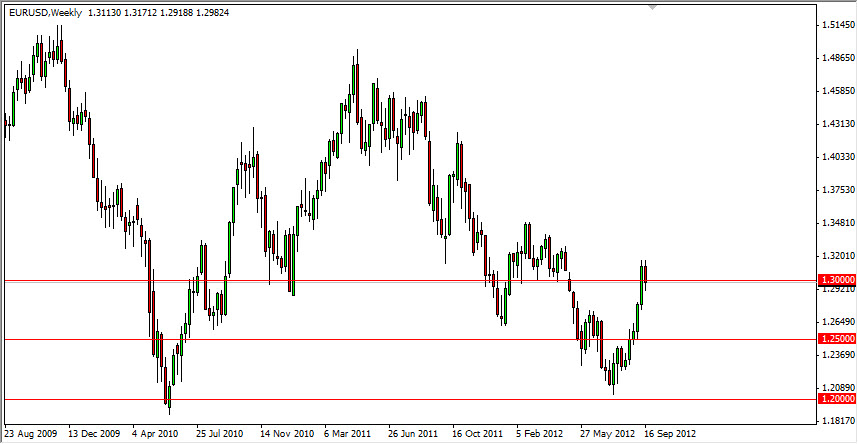

EUR/USD

The EUR/USD pair fell a bit over the course of the last week, but let’s face it: This pair continues to grind higher and higher – no matter what is going on in the EU. The debt crisis should continue, but the markets seem to be focused on the Federal Reserve and its QE3 program at the moment. Because of this, I think this pair is still bias upwards, and has support at both the 1.30 and 1.2750 levels.

Someday, the market will focus move on the problems and recession in the EU. Until then though, this pair seems destined to go higher. I do think the next few handles are going to be a bit difficult, so pullback are the best way to enter.

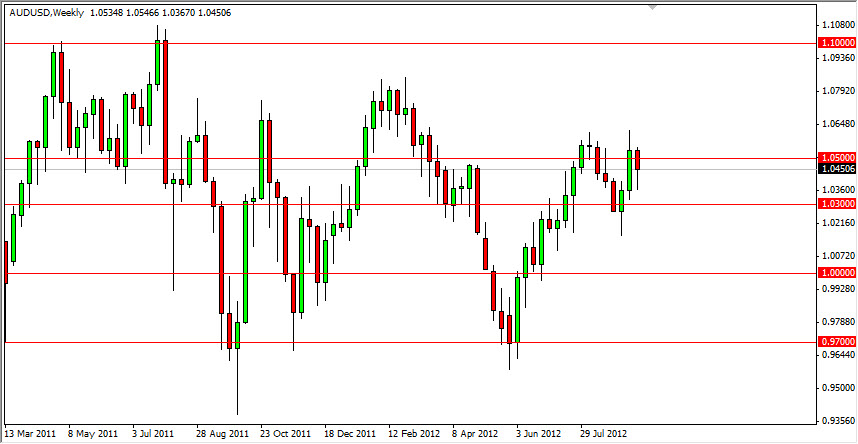

AUD/USD

The Australian dollar has been a bit perplexing for a lot of my fellow traders lately. This is simply because there are two very distinct and strong forces working both for and against it at the moment.

The Federal Reserve doing more quantitative easing helps push commodity prices higher, and by extension the Aussie dollar. However, the Aussie is currently being punished a bit for the slowing in China. After all, the Aussies supply China with quite a bit of its raw material needs, and therefore the Aussie dollar is often played as a proxy for growth in China. Because of the slowdown, this is working against the Aussie, and as a result it should still underperform the other commodity currencies, but still looks very buoyant.

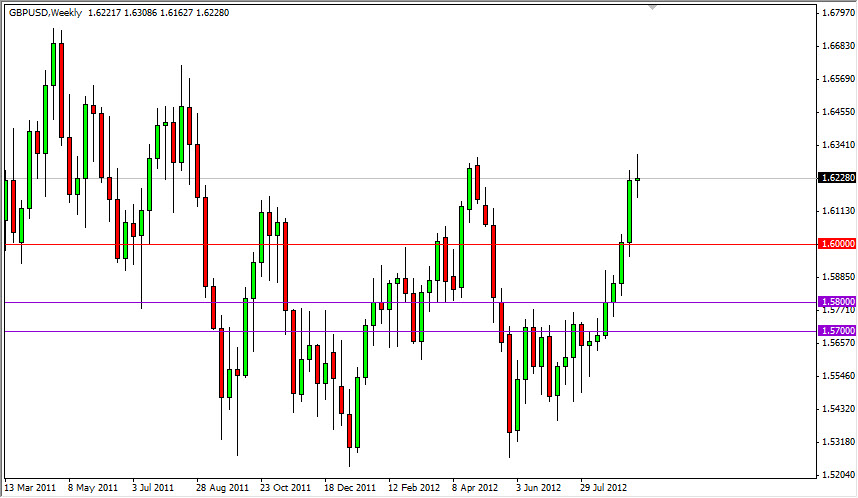

GBP/USD

The cable pair had a volatile week, but in the end closed just slightly higher. The resulting candle was a bit of a doji, and this suggests that perhaps we are seeing a slowing of momentum by the bulls. This isn’t a bad thing, as the rally is very overextended at this point.

The 1.63 level looks like significant resistance, but with the Bank of England keeping its rate and monetary policy on hold, it is a bit of an outlier in the fact that most major currencies are easing at the moment. Because of this, I think the British pound will be one of the strongest currencies over the next couple of months on the whole. Obviously, there will be pullbacks, but I really like this pair. I get especially interested if we pull back to the 1.60 level.

USD/JPY

Although I sincerely believe we will eventually see this pair bounce back, the fact is that it tends to follow the yields of the ten year Treasury markets in the US. As the Federal Reserve is determined to keep rates low with buyback programs, I think this pair is going to be “dead money” for a while. It will take a weekly close above the 80 handle in order to get bullish again.