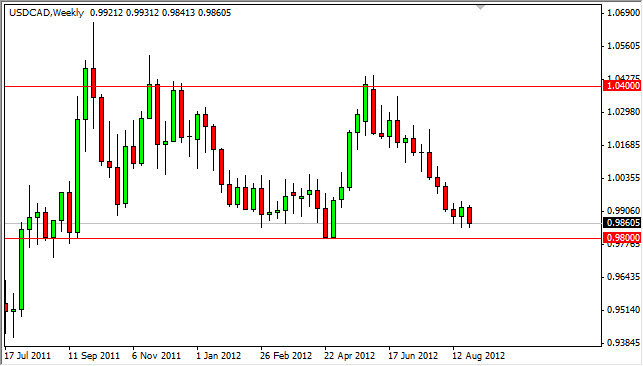

EUR/USD

The EUR/USD pair rose most of the week, but managed to give up quite a bit of the gains in order to form a shooting star. Even more interesting is the fact that the top of the shooting star is at the 50% Fibonacci retracement level from the plunge in this pair back in the middle of spring.

The bottom of the shooting star is at roughly 1.24, and as such I think that if we manage to break below it, we will certainly see much lower prices. Eventually, the Euro could hit as low as 1.20 based upon that move. Alternately, if we manage to get above the 1.27 level, we could see a move towards the 1.30 level.

EUR/GBP

The EUR/GBP pair had a very similar week as we attempted to rally, but failed at the 0.7950 level. What is interesting to me is that this is the beginning of the resistance that goes all the way to the 0.81 handle. If we can get above this area, it's very unlikely that it will manage to break out completely. In fact, I am not buying this pair until we print 0.8150 in order to show that the momentum has shifted. For me, a looks much easier break down below the 0.79 handle which would show the shooting star triggering sell orders.

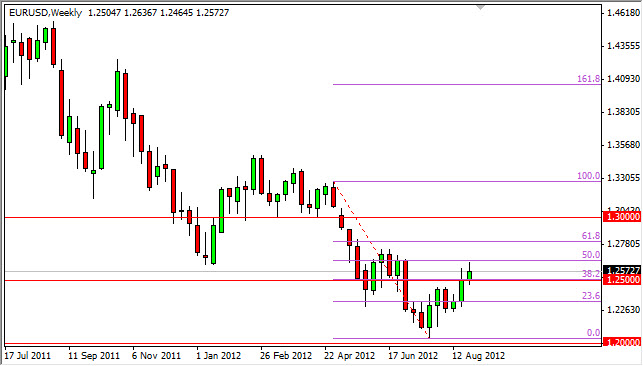

GBP/USD

The GBP/USD pair fell in order to retest the zone between 1.57 and 1.58, only to bounce back above it and prove that the area is going to act as support now. This area was previously resistance for an ascending triangle that we formed all summer, and as such this pair looks extremely bullish. Without going too deep into the words, this has a lot to do with the bond markets, and the higher return you will get in Britain. As things look now, a break above the 1.59 handle should send this pair all the way to 1.63 before it's all said and done.

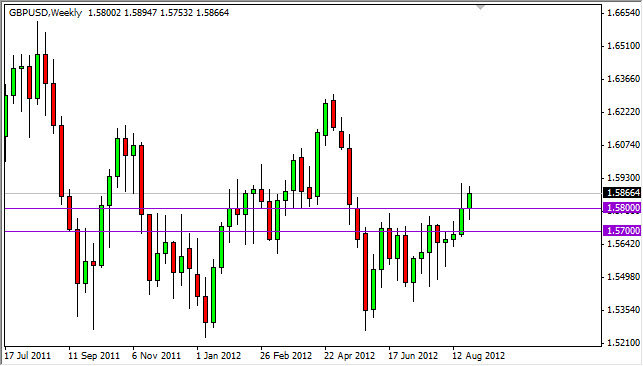

USD/CAD

The USD/CAD pair fell during the week in order to retest the 0.98 handle again. We are quite down to the actual level yet, but rather testing the "meat" of the support zone. Overall, this pair looks very consolidative, and as such a bounce from this area is entirely out of the question. However, I have not seen the supportive candles to suggest that yet. The oil markets will be a big factor of course, and as the price of the black commodity rises, the Canadian dollar will gain against the US dollar. However, if there was ever a spot where a pair could bounce - this is it.