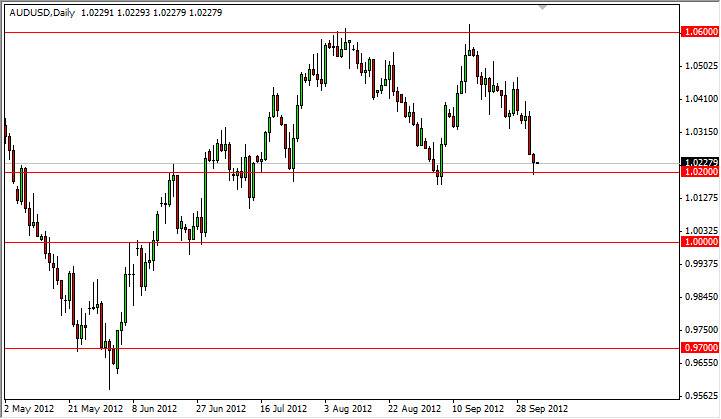

The AUD/USD pair fell during most of the session on Wednesday as the commodity markets took an absolute shellacking during the session. The market fell down to the 1.02 level and as such found support at this obviously important level in this currency pair.

The daily candle for the Wednesday session formed a hammer, and this does suggest that perhaps some buyers are starting to step into the marketplace. With the nonfarm payroll numbers coming out on Friday, it is very possible that we will see a hesitation to sell this currency pair off until that announcement comes out.

The 1.02 level looks to be the last gateway until we get to parity for the sellers. The Reserve Bank of Australia is expected to cut rates a couple times in the near-term, and as such it should continue the pressure on the Australian dollar overall. However, at the same time we have the Federal Reserve expanding its quantitative easing policy, which of course is very Dollar negative. Because of this, we could be looking at the development of a battle much like in the USD/JPY currency pair. In that particular market, we have two central banks trying everything they can do to devalue their own currencies.

Nobody can kill a currency like the Federal Reserve

While it does look like the Australian dollar will fall in value over time, one can never count out the ability of the Federal Reserve to destroy the US dollar. Because of this, I expect to see this pair fall but not as far as many people would think. Remember, the Federal Reserve has essentially written itself a blank check as far as time is concerned when it comes to the amount of easing.

Gold markets are rising, and this of course will counterbalance the attempt by the Australians to devalue the currency as well. In the end, I do believe that this market will retain some sense of bullishness, but perhaps after some type of pullback. With this in mind, I am willing to sell this currency pair if we break down below the 1.0150 level for a move down to parity. If we bounce higher, and clear the highs from the Wednesday session I would be willing to take a long position in this market and aim for the 1.0350 handle.