By: DailyForex.com

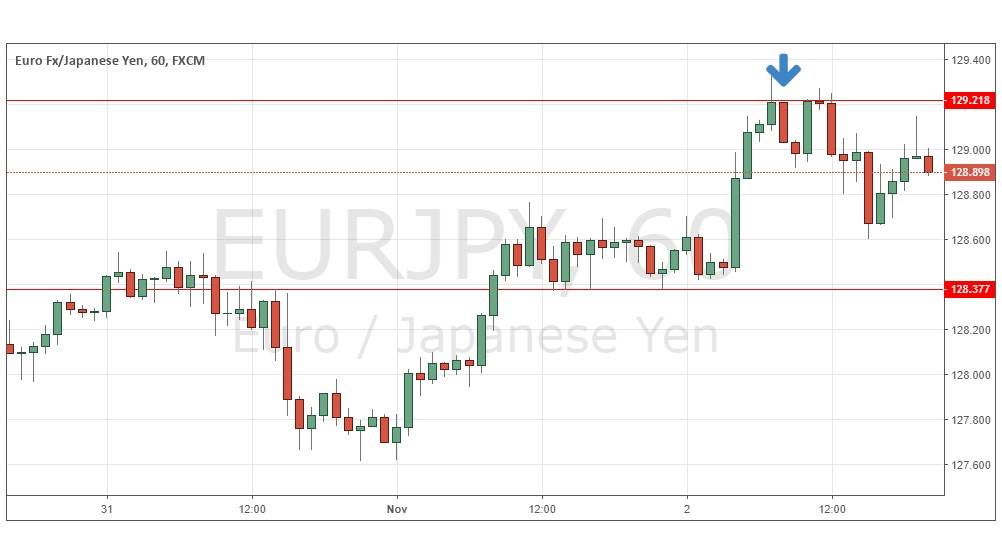

EUR/JPY rose during the session on Friday as the Euro continues to gain against most currencies. This pair is particularly interesting to me as the Bank of Japan is actively working against the value of the Yen in various ways. As long as the world is relatively placated by the actions going on in Europe by the region's leaders, I believe that this pair will continue to go higher without much difficulty.

The 100 level looks to be a floor in this market at this point time to me and as such I think that this is a "buying only" market. I will continue to buy supportive candles as long as we can stay above 100, and would even consider adding until we get to the 104, and possibly 105 handle.

As long as the world isn't focusing on the underlying problems in Europe, there's really no reason for this pair to fall. After all, the Bank of Japan is actively working against the value the Yen through quantitative easing, and more than likely some extension of that from this week's meeting. Whatever they do, this should more than likely continue to pressure the Yen, and as long as the world doesn't get overly concerned about debt in places like Spain and Italy, there's no reason why you should even consider shorting this pair. In fact, I use the 100 level as my measuring stick.

Trend change

While there will certainly be times when the Euro falls in value against all currencies, I do believe that the trend has changed in this pair, and that we are going to start grinding higher over the long term. In fact, I think that the 110 level is very reachable by the end of next year. Based upon this, I am buying dips as they come and supportive candles as they are shown but placing my stop losses well under the 100 handle.

As for selling this market, I have absolutely no reason to think I should, at least until we get below the 98 handle. This is far below where we are right now, and seems to be very unlikely to happen for the time being.