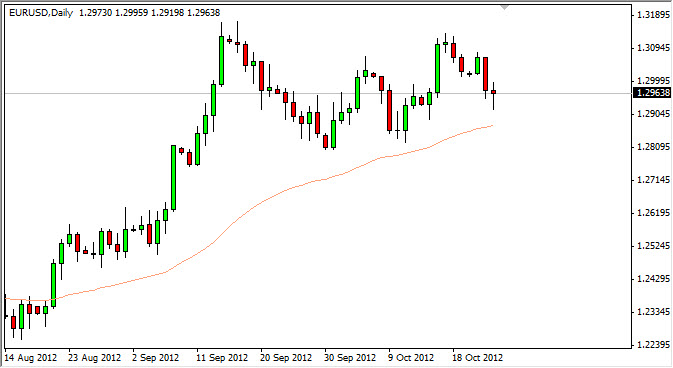

The EUR/USD pair fell during most of the session on Wednesday, as one would expect as stock markets around the world fell. We are still sitting around waiting for some type of bailout request Spain, and until then comes it will be a bit of an overhang to the value of the Euro. However, by the end of the session we saw a nice-looking hammer formed which seems to be centered on the 1.2950 level.

This area has been resistance previously so now that is showing signs of support are in a huge surprise. In fact, this could lend itself to be a sign that we are going higher. On a break of the highs from the Wednesday session, this is a classic technical analysis signal to go long.

I do see a taunt of resistance and noise above this current price though, and it does keep me a little bit off put by this pair. Not to mention the fact that the headline risk are numerous, and seemingly never-ending. Out of the blue, you could easily wake up in the middle of the night to check your charts and find out that you are suddenly 150 pips lower based upon some random comment.

1.35

For me, I think that once you get above the 1.3150 level, you will have a significant amount of trouble getting to the 1.35 handle. This is a massively noisy area based upon previous triangles the informed, and as such it will take something special for the market to breakout and above the 1.35 level.

On the other side, I see a lot of bearishness in this market if we can get below the 1.28 handle. The problem with the immediate vicinity is that it has been beat up in shooters so many times that it is almost indistinguishable from a big blob instead of something that you can see straightforward support resistance levels over the long term. Because of this, I would go long of the Wednesday highs because it shows that the buy signal from the hammer has broken, but I would only be looking for a short-term trade.