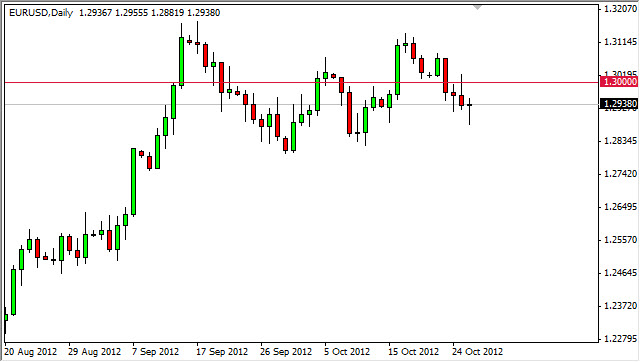

The EUR/USD pair fell on Friday as the markets were basically in a “risk off” mode. The Euro continues to represent a region that has a plethora of problems, and as a result there is always a bit of a “dark cloud” hanging over the currency. The Friday session saw the buyers step back in though, and as a result we had a hammer print for the session.

The 1.30 level above has been resistive and as a result this pair simply cannot hold the gains. Granted, I see the chart as having a slow upward bias, but I certainly wouldn’t be comfortable buying this pair at this point in time. The area above the 1.30 level is treacherous for the buyers, and I see this being the case all the way to the 1.35 level.

This resistance is based upon the descending triangle that formed back in February, and it looks as if the buyers are going to struggle to get the gains to hold. The recent lows have been getting higher, but only just. This looks as if it is a pair slowing grinding sideways, but there is a certain amount of “hopium” out there to keep supporting the attempts higher.

Europe….

The European Union continues to be a mess as far as finance is concerned. The debt crisis is still there, and the Spanish have decided that pride is more important than being bailed out. In fact, the Spanish PM was recently quoted as suggesting Spain didn’t need a bailout at all. With this in mind, we simply do not know when they will ask for the help they need. However, if they do the Euro will more than likely get a strong relief rally. However, this will eventually lead to easier monetary policy out of the ECB, and this will bring the value back down.

The previous candle was a shooting star, so it appears that we are simply going nowhere fast. Because of this, I find this pair a tough place to make a profit at this point in time, and have been sitting on the sidelines lately.