The EUR/USD pair has been a great place to lose money lately. The choppiness is been shown in this marketplace is essentially the resolve of a lot of confusion on both sides of the Atlantic. After all, the Spanish have yet to ask for the bailout that everybody expects him to, and the Federal Reserve continues to ease its monetary policy. Because of this, we have come up with a game of "hot potato", where the potato is the back and forth of anxiety across the Atlantic.

This pair is essentially a question of "who is worse this week" as the sentiment in this currency pair goes back and forth so rapidly. However, over time we have seen the Euro appreciate in general, it should be thought of as the natural order of things. Certainly this was the case for years, and even though I personally do not trust the Euro, I cannot argue with the fact that the currency just won't die.

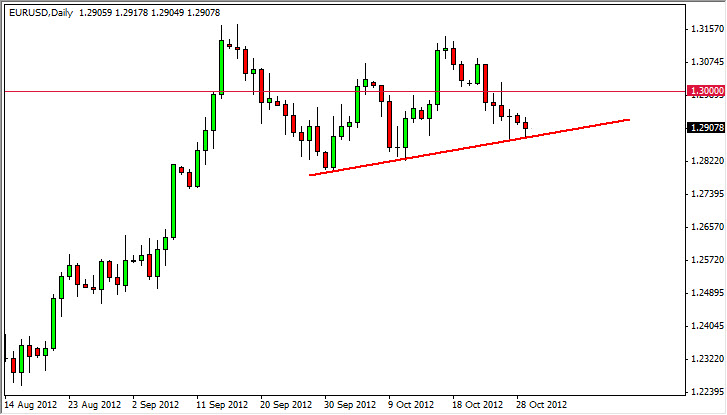

Uptrend line

Over the last couple of weeks, we have formed a bit of an uptrend line that could be a guide for traders. After all, the last high was higher than the one before, so we are technically back in an uptrend. With that being said, the struggling could be used as a "line in the sand" if you will, as you could go long of this pair and put your stops behind it.

For me personally, I do not like choppy markets like this but it can be said that this is more or less consolidation and as such we are closer to the lows than the highs. This means that you would more than likely favor buying the Euro, and as such many of the short-term traders out there will be involved in this pair. For me, I think that there is a taunt of noise between 1.30 and 1.35 or so in this marketplace, which is something that I choose to avoid. On the downside, I see 1.28 is obvious support and would be willing to short this pair hand over fist if we break down below that level on a daily close. In the meantime, I think short-term trading opportunities on the buy side have to be looked at as the only feasible opportunities in this marketplace. Make sure that your stop losses are tight, and that you don't hesitate to take profits when you get them.