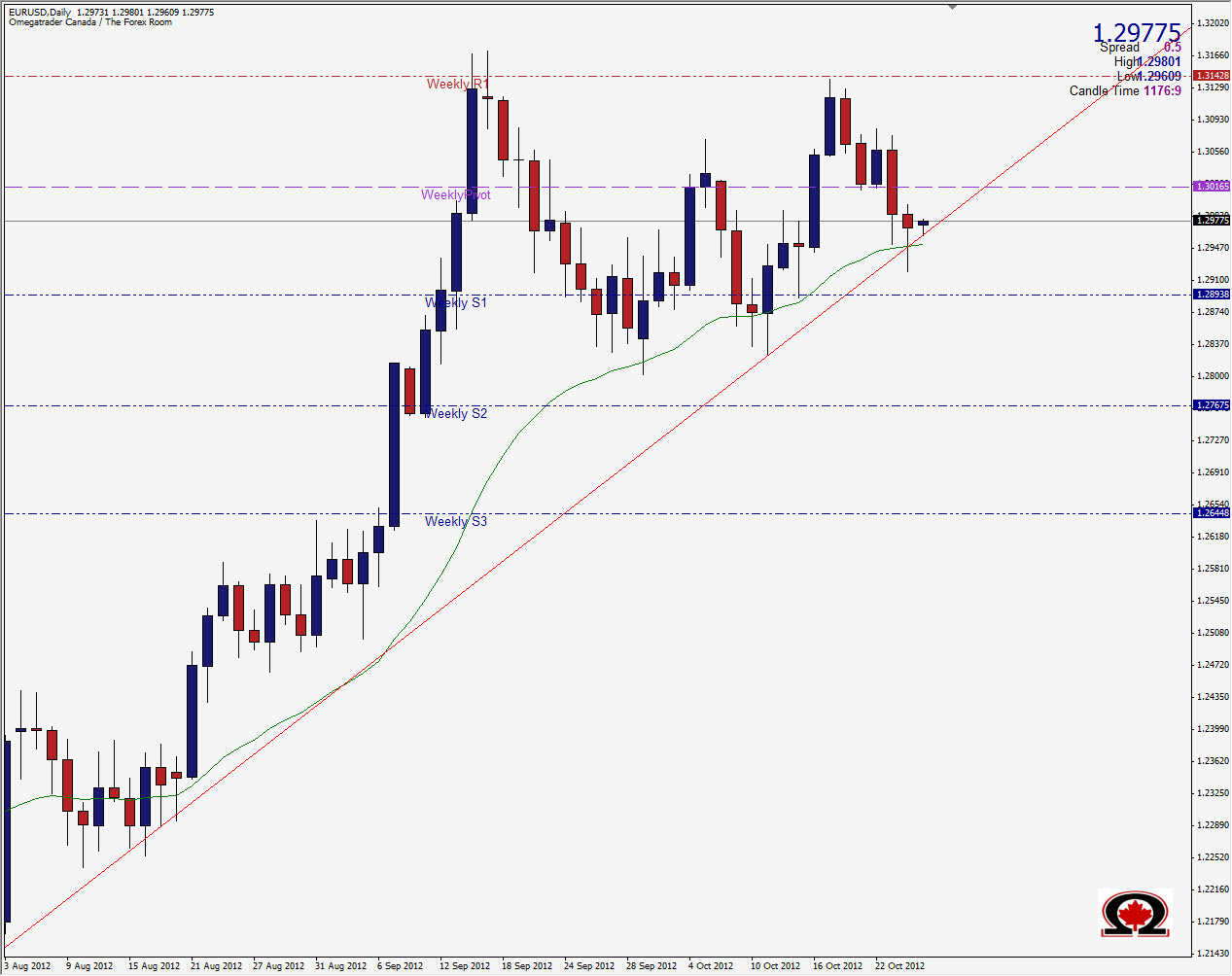

The EUR/USD has appears to once again found support at 1.2920, printing a Daily Pin Bar Reversal at this level and continuing to honor the ascending trendline that began back in July with the 6 month low at 1.2042. The pair also bounce off of the 25 day SMA at 1.2950 and is looking like it will possibly renew its Bullish tone. If the high from yesterday is breached at 1.2996 we could see tha pair run back up to test the 1.3150 level again. Watch out for resistance from the Weekly Pivot at 1.3016 as well as previous closes at the Weekly R1 area of 1.3130-1.3140. Beyond 1.3150 strong resistance can be found at 1.3260 and 1.3340. However, if the low of yeaterday is breached, the bearish tone renews and we begin looking for support such as the Weekly S1 at 1.2894, Weekly S2 at 1.2765 and 1.2645 is the Weekly S3 and the 50% retracement level for the Bullish run up between July's low and September's high. I am hesitant to suggest going long at this level however as there is strong resistance at that Weekly Pivot level, personally finding a break of the low slightly more appealing. That said, yesterday's candle is a textbook Pin Bar at a good level, so breaking the high could change my mind.

EUR/USD Rejects 1.2900- Oct. 25, 2012

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup- Labels

- EUR/USD