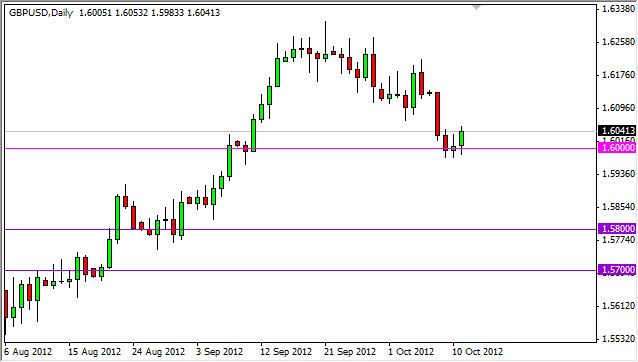

GBP/USD rose during the session on Thursday, as we bounced off of the 1.60 handle in a show of strength. The fact that the Wednesday candle was a shooting star and we broke the top of it also suggests that we are starting to see a pickup of buyers as well. It should be noted that the 1.60 level is roughly the 50% Fibonacci retracement level from the breakout of the ascending triangle as well. Is because of this that I became so interested in this move.

The Bank of England continues to keep its monetary policy on hold, and this of course is much more positive than the monetary policy of the Federal Reserve. With the Federal Reserve continuing to expand its monetary easing, this essentially keeps the interest rates between the two countries at a widespread, and of course in the favor of the British. At the end of the day, this is one of the biggest influences of the direction a currency pair will travel in the Forex markets.

1.60 could open the door to 1.65

Looking at this pair, I can see that the 1.65 level is more than likely where the buyers want to take it. I don't think that this move will be clean and easy, in fact I think it'll be far from it. But at the end of the day, this pair does look rather bullish. We need to get above the 1.63 level in order to continue the bullish trend, but I think this is going to happen.

I see the 1.65 level as being the next target for the buyers of this market once we get above the 1.63 level. In fact, I believe that 1.70 handle will be seen sometime next year, and as such I am currently looking to buy pullbacks in this market on the short-term charts. I believe that the British pound will continue to gain against the US dollar over time, especially as continentals in Europe find their money flowing into the British Isles, and away from places such as Spain, Italy, and Belgium.