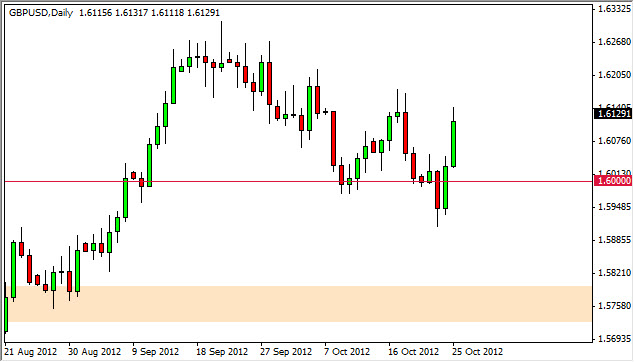

The GBP/USD pair rose drastically during the session on Thursday as the support at the 1.60 level continues to give the buyers confidence. At this point in time, it appears that the 1.62 level will be the next hurdle to overcome follow shortly behind by the 1.63 level. I had mentioned several times before that I think this pair will eventually hit 1.70, but of course this will take serious time. In fact, I'm thinking that it would if that level sometime late next year.

In the meantime, I do expect a bullish bias, after all the Bank of England continues to keep fairly quiet about its monetary policy, insisting that it is perfectly fine where it is. Meanwhile, we have a central bank in Washington DC that insists on printing currency as fast is a possibly can. In a world that most currencies are printed electronically, this is an extraordinarily quick process.

The recent action in this pair figured in a nice ascending triangle during the summer, which of course was broken out well above the 1.58 level. The interesting thing about that breakout is that the triangle measured a move to the 1.63 level before was all said and done. This is exactly where price action stopped and reversed. Now that we have pullback, it appears that the 1.60 level, which of course is the 50% Fibonacci ratio from the breakout has offered support. Because of this, I feel that this is a natural place for the bullish momentum to continue higher.

1.63 will be crucial

For me, this pair needs to make a higher high in order to reach my ultimate target of 1.70 by next year. If we can get above 1.63, this will not only show that we are extending beyond the original measured move, but we are also making a "higher high", which of course is the very essence of an uptrend. With that in mind, that point time would make me extremely bullish of this currency pair, and have me adding on to my long positions very liberally.

As for selling this pair, I don't have the argument to do so right now, and would need to see the 1.57 level give way before I would even consider it. Until that happens, and I highly doubt it will, I will not sell this currency pair.