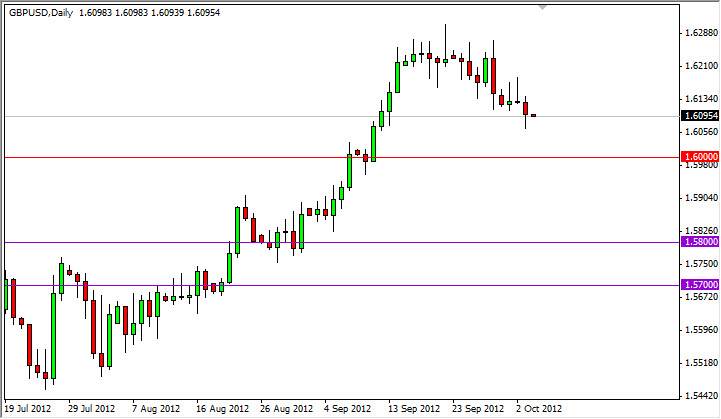

The GBP/USD pair fell during the Wednesday session as the pair looks set to pullback finally. We have seen a nice strong rally over the last several months, and the breaking out above the 1.58 level signifies that an ascending triangle had finally been triggered. The target was the 1.63 level, and we have hit that area. Now the real question is whether or not we can continue higher.

The candle for the session on Wednesday did form a hammer of sorts though, and this of course suggests that we may be seen a little bit of support. I personally believe that the 1.60 level is much more supportive based upon not only historical action, but the big round number aspect as well.

I see support down at the 1.58 level as well obviously, as it was the top of the aforementioned ascending triangle. With the bank of England currently very happy with its monetary policy and the Federal Reserve willing to expand its quantitative easing seemingly unlimited and its scope, it makes sense of this currency pair should continue higher. After all, the US treasury markets feature bonds that simply pay almost nothing while the British gilts seem to be doing much better as far as yield is concerned.

Looking for support

On supportive action, I am a buyer of this pair. I believe that this market will continue much higher, and I would not be surprised at all to see us in the 1.70 area within the next 6 to 8 months. This isn't to say that we won't see pullbacks, we most certainly will - but the truth is that this pair should continue much higher and the Federal Reserve certainly won't mind.

Until the Federal Reserve changes its monetary policy, it's hard to imagine a situation where this pair gains for any significant amount of time. Granted, there will be the usual "flight to safety" trade that sometimes has money running to the US dollar, but in the end yield is the one thing the world is looking for currently. This pair does pay a positive swap, and that is something that you should never underestimate the power of.