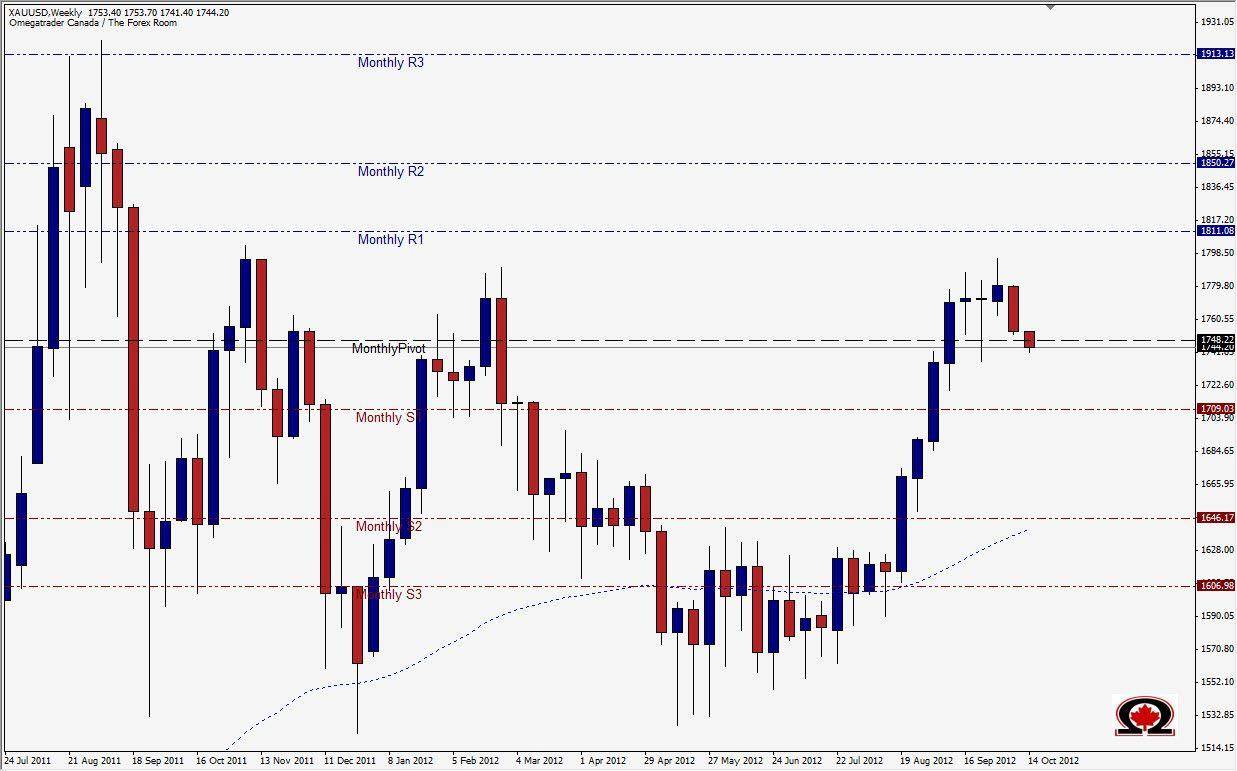

The Greenback gained against Gold last week, or Gold weakend against the Greenback, however you look at it the pair XAU/USD dropped almost 300 pips last week and has started this week off by continuing to trade lower in Asian trading. The pair has fallen an additional 120 pips with roughly 2 hours remaining in the Tokyo session. Support for this pair is a tough one to nail down, as the range it is trading in was created in the last 14 months and the moves in those months have been quite stellar. This leaves only a few real key support & resistance levels, one of which being the current level of 1745 +/- 5 pips. Twice in the past 12 months the pair has reversed its direction at this level in a big way and could be setting up to do so again. Considering the run higher that occurred over August & September of this year, it is possible we are retracing to this level so the Bulls can use it like a spring board and push prices higher. Another scenario is that we see a much deeper retracement if 1720 +/- is taken out. In that case we might see a move lower to one of the key FIBO levels such as 38.2 @ 1693, 50% @ 1661 or even the 61.8% area @ 1629.50. I would be very surprised to see the price drop this much however and looking at a weekly chart would expect price to turn around at the 50% level or higher. That said, we can only trade what the charts are giving us, and in this case the trades should be shorts until we see a more Bullish pattern on the Daily Chart.

Happy Trading!