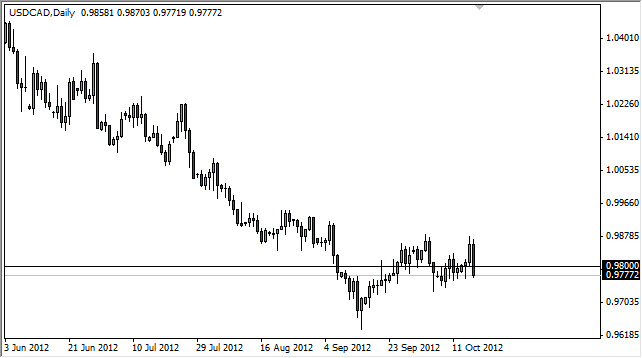

The USD/CAD pair had a very bearish session on Wednesday as the 0.98 handle has been overcome by the sellers yet again. Ultimately, I see the 0.98 handle as the equilibrium for this market. The trend is most decidedly down, so I prefer to sell given half a chance.

Ultimately, I believe that this pair will go much lower as the Federal Reserve continues to punish the US dollar. The oil markets will of course have their usual effect on the market but over time it cannot be stressed enough that the Canadians are adding jobs, while the US simply isn't. You have to keep in mind that the Bureau of Labor Statistics puts out an employment number in the United States that is using a lot of assumptions. On the other hand the Canadians simply count their jobs and tend to have much less severe revisions.

To put things in perspective, over the last year or so the Canadians have added 820,000 jobs. With 1/10 of the population that the Americans have, this would equate to adding 8.2 million jobs in the United States! This is really how different these two economies are at the moment.

If we can get below the 0.9750 level I am more than willing to start selling. I had previously been waiting for a little bit lower pricing, but the truth is that I believe this pair is ready to start moving based upon the way that the 0.99 handle has been so resistive. Alternately, if we got above the 0.9950 level I would have to admit that this pair will go higher. Nonetheless, it looks like a continuation of the very bearish attitude that we've seen over the last several months, and as a result we could see 0.95 in relative short order.

The US Dollar Index certainly shows that the greenback is ready to start weakening, and this will be one of the more interesting pairs in order to express that value. Because of this, I am bearish this pair as long as we can get below the hammer from last week, which I believe is the gateway to lower prices.