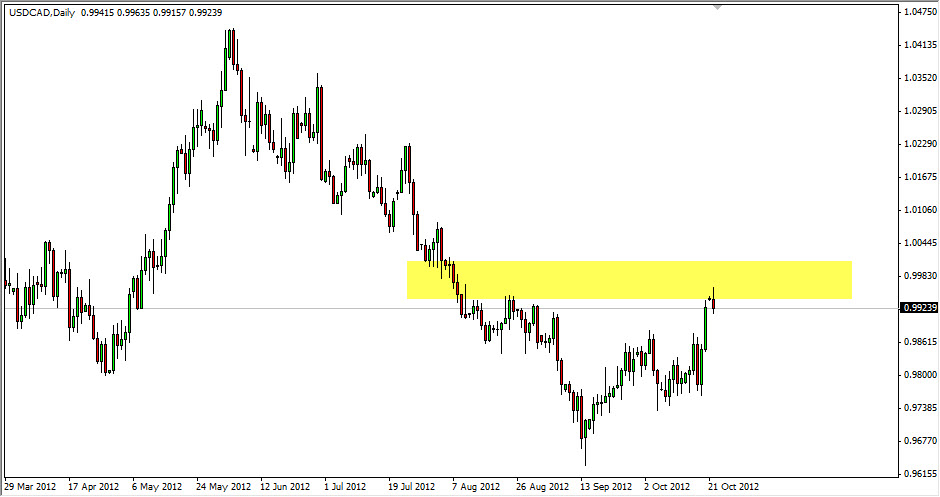

The USD/CAD currency pair fell during the Monday session as the buffer above the 0.9950 level held as resistance. The area extends all the way to the parity level as far as I can tell, and as such this will be a very significant area to over, if the buyers are to take over. Also, you should keep an eye on the oil markets as the two tend to be inversely correlated, with the oil markets falling as is pair rises and vice versa.

The candle shape for the Monday session is a bit of a shooting star, and this would've been predicated upon the bullishness that we solve towards the end of the US session. Stock indices rose everywhere in the last hour, and the silver was seen being bought with a 5 to 1 ratio in the options pits. In other words, there was suddenly risk appetite late in the day.

Resistance and shooting star

When you get a signal like this, it pays to pay attention to and as you don't see them all the time. Granted, anything can happen and the trade can certainly go against you - but we have a very clear and decisive "line in the sand" when it comes to this pair. If we get above the 1.0050 level, we have broken out to the upside and we should be long. However, as long as we are underneath this area and the fact that we formed a shooting star suggests to me that we could very easily fall back down.

The beauty of selling this pair of course is the fact that it does go with the overall trend. Nonetheless, I need to see a break of the 0.99 handle in order to get overly bearish. Also, I would need to see the oil markets pick back up and find some momentum to the upside. This is something that isn't necessarily likely, and that is part of what gives me a bit of caution when approaching this currency pair. I will follow the technical signals, as sometimes that's all you can do. With those two possible scenarios, I will place a trade in this pair accordingly.