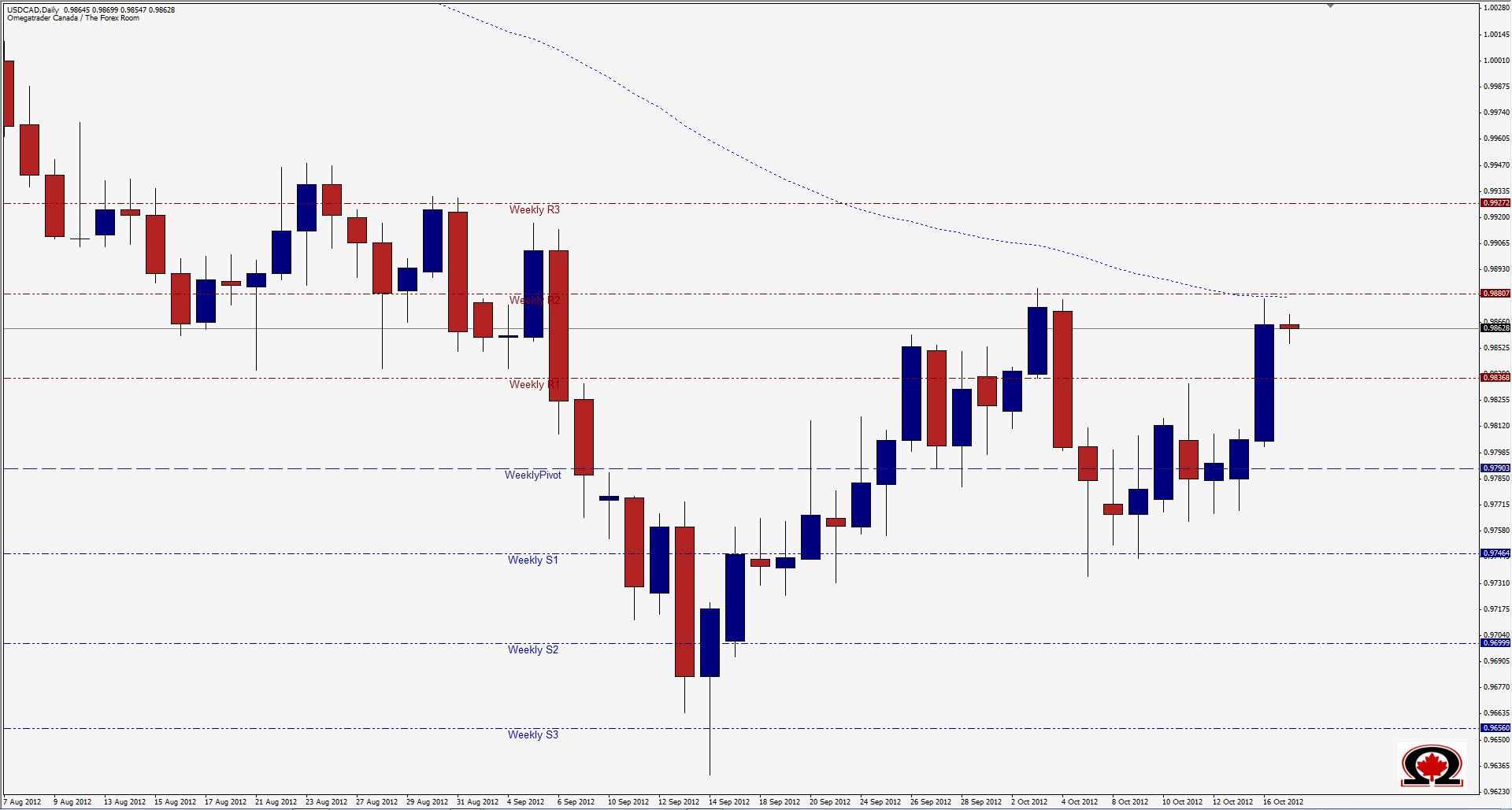

The Canadian Loonie lost some ground against the US Greenback yesterday, climbing some 76 pips to 0.9878 and kissing the 62 Day Moving Average at the same area. The pair has been in a solid downtrend since hitting an 11 month high in June of 1.0446 and a low on September 26 of 0.9683. So is the US Dollar getting stronger, or is the Loonie just taking a breather and much needed correction before resuming its trend? The chart is inconclusive at this point for a longer term prediction, except for the fact that September's Monthly candle was a Pin Bar that found support at 0.9680, the same place price reversed in June 2011. At that time, the pair did fall lower, to around 0.9406 before reversing to hit the 24 month high 3 months later at 1.0657. So this could very well be the start of a Bullish run but this analyst isn't sold on the idea just yet. First of all, we have only retraced about 29% of the Bearish run that ran from June to September, meaning that there is room to go higher, but that key levels have not yet been tested as resistance yet. The first will be at 0.9943 where the 38.2% FIBO sits. If this level is breached on a daily time frame there is a technical vacuum up to the 50% area at 1.0039 but then it gets messy again. There is heavy repetitive support & resistance above 1.0039 about every 40 pips. All it will take is for oil prices to rise and the Loonie should go with it and push the chart back down. For now, if we close above 0.9900 I will be monitoring the 0.9950 level closely.

USD/CAD Heading for Par- Oct. 17, 2012

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- AUD/JPY