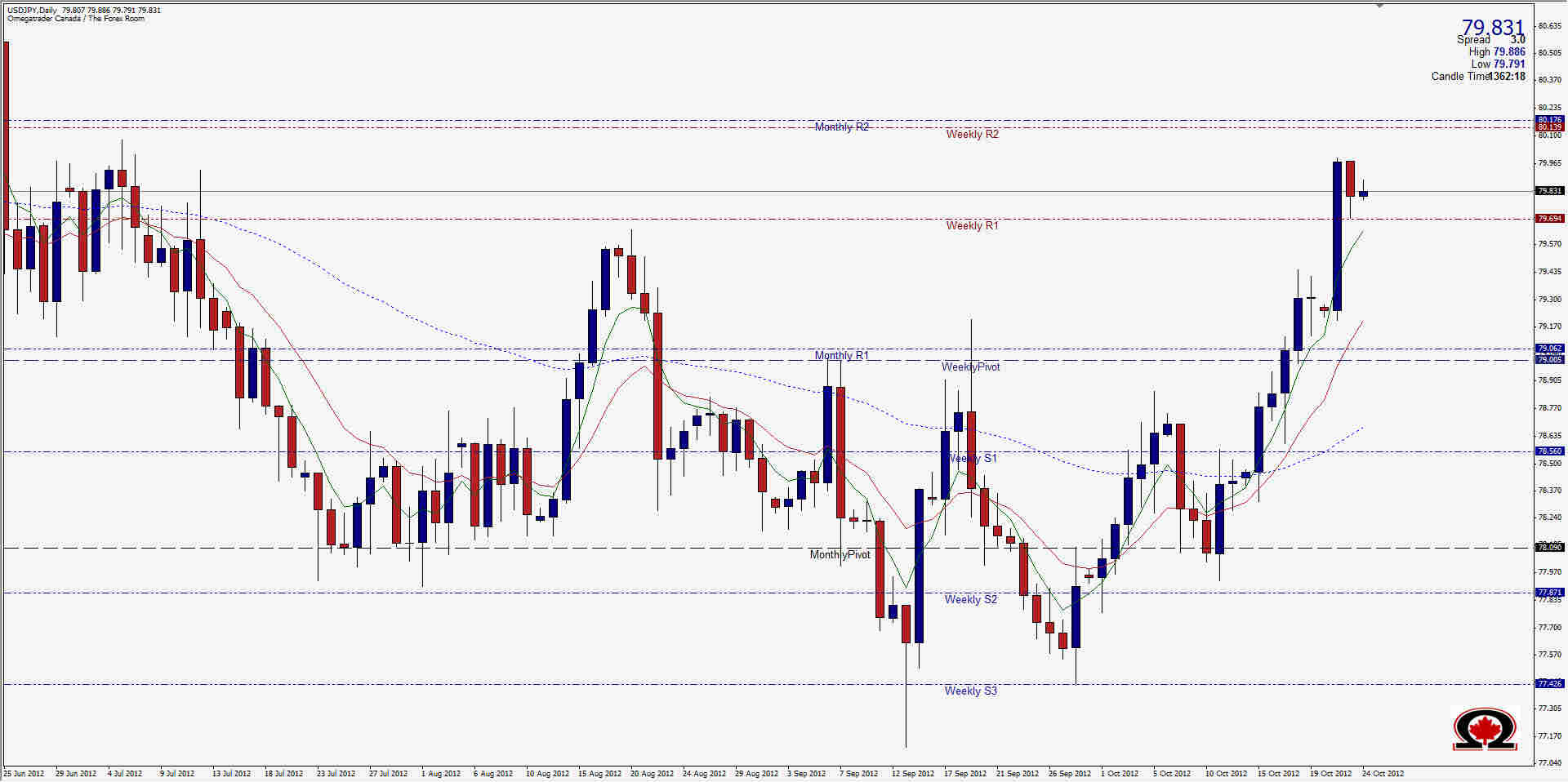

The day before yesterday the USD/JPY surged some 75 pips higher after opening to close just shy of 80.00 at 79.994. Then yesterday the pair peaked at 79.978 before falling to the 38.2% retracement level of the day before, closing just 11 pips above the Weekly R1 at 79.808. So the question is...is the pair going to reverse and continue with its Bearish tendencies or will it break the 80.00 level and push higher? One argument in favor of the Bulls is that the pair has now closed above the 62 Week Moving Average at 79.52 and a weekly candle close above this level would certainly point towards higher prices to come. The pair also seems to have broken out of the descending weekly channel it has been trapped by for the past 6 months, which also might hint that the pair is getting revved for a Bullish push higher. If the pair does break 80.00 there is some heavy traffic to the left with a Weekly R2 intersecting a Monthly R2 at 80.15, numerous reversals at the 80.50 level and a Monthly R3 at 81.15. The bulls certainly seem to have their work cut out for them. The Bears however might have an easier go of things with a technical vacuum below the Weekly R1 at 79.694 down to 79.00 where the Weekly Pivot and Monthly R1 also intersect. Truth be told, there is congestion every 50 pips or so in both directions, but the bulls might come out on top in the end.

USD/JPY Capped At 80? Oct. 24, 2012

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- USD/JPY