The USD/SGD pair probably isn’t a pair that most of you pay too much attention to, and this is a real shame truth be told. The pair has a habit of trending nicely, and has a reasonable spread. (Most brokers are at 7 pips or less. Mine happens to average about 4.) This makes is a very “tradable” pair for me, and I find it one of my favorite Asian currencies to trade.

The “Sing dollar” is somewhat of a proxy for Asian exporting – read China. This allows people to trade how the money flows from the West to Asia, as Singapore is an exporter, and a financial hub for Asian banks. This means that the Sing dollar by extension is a “risk related” pair, and will fall as long as the global risk appetite is generally strong. This is typical, as the US dollar is the ultimate “safety trade” for Forex traders.

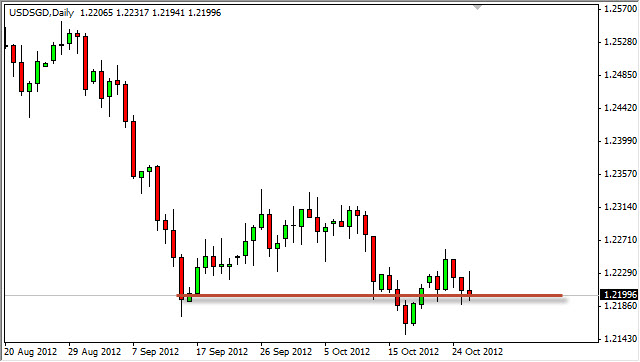

The trend is most certainly down in this pair, and the great thing about the market is that it typically moves fairly slowly, and this makes it a comfortable market for the new traders as the volatility isn’t that great. This is due to the fact that the Singapore Monetary Authority (Singapore’s central bank) keeps this pair in a general “trading band” in order to keep the currency pair from melting down. If you ever wanted to know which direction the money is flowing, this of this: The world renown investor Jim Rodgers recently moved his family from the United States to Singapore so that his young children would have a brighter future. In other words, we typically see the Sing dollar appreciate over time.

Nice looking candle for continuation

The candle that formed for the Friday session looks like a shooting star, and it is at the bottom of the recent downtrend. This looks a lot like a failure by the bulls to push prices higher. Adding to the importance of this candle is the fact that it sits at the 1.22 handle. The round number is an area that was previous support back in September, and as such it wouldn’t be a surprise to see it act as resistance. Because of this, and move below the lows from the Friday session has me selling again.