By: DailyForex.com

EUR/USD

The EUR/USD pair continues to be a mess. The weekly candle is supportive in the sense that it looks a bit like a hammer, but the daily candle on Friday was a shooting star. The pair looks like it is getting “tight” again, and as such it will be difficult to trade in the near term.

The market sees a lot of noise and resistance just above current levels from 1.30 to the 1.35 handle. This area should continue to keep the buyers at bay, but there is also a bit of an uptrend line to worry about for the sellers on the daily charts. Because of all of this, I believe that it is probably a pair best avoided in the short-term.

AUD/USD

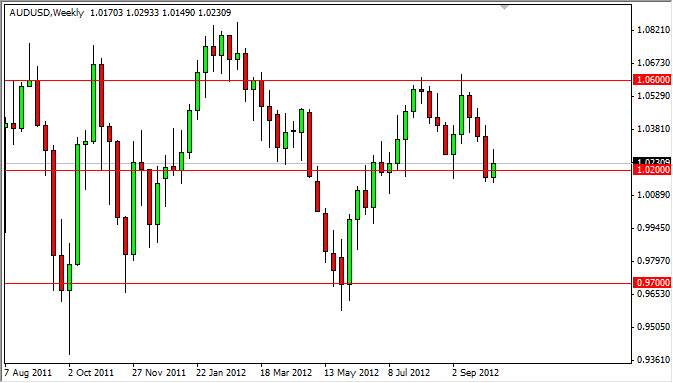

The AUD/USD pair had a slightly positive week, but nothing to write home about. This pair continues to suffer as a direct result of a weakening Chinese economy. The interconnectivity of the two economies is stronger than ever, as the Aussies have been selling so much of their raw materials to China.

Once we get below the 1.0180 area, I believe this pair will run to parity, and then 0.97 or so. This market is highly sensitive to risk appetite, which I see getting weaker and weaker as time goes on. I am not at all encouraged by the recent price action, as suspect this market will fall soon.

USD/CAD

The USD/CAD pair had a slightly bullish week, but failed to close above the 0.98 handle. This level is important as it was once support for the greater consolidation zone. The fact that the market doesn’t seem very comfortable above this level is probably a tell of sorts. This pair will react to oil prices, and as such will be headline sensitive.

With all that is going on that could push oil prices higher, the demand just isn’t there for the commodity. In other words, although I see this pair as being somewhat bearish – I don’t think this will be an easy and straightforward trade. This market likes to grind sideways for long periods of time, and I think this is what we are going to see now…..with a downward bias.

EUR/GBP

The EUR/GBP pair did almost nothing by the end of the week. However, it is at an important level, and the fact that it just “sat there” is in and of itself rather surprising. The 0.81 level looks to be resistive, and as long as we are below it – I feel the consolidation between 0.79 and 0.81 will continue.

Both of these currencies have enjoyed a strong run as of late. However, I think that the fundamental strength of the British pound will reassert itself over the Euro in the short run. A resistive candle in this area is enough to get me to short this market on a continuation play.