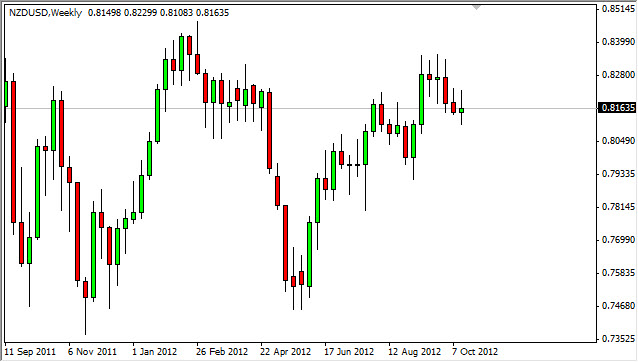

NZD/USD

The NZD/USD pair initially surged during the previous week, but gave back quite a bit of the gains it enjoyed in the beginning. The Kiwi dollar is of special interest to me because of it represents the overall "risk appetite" of the markets on the whole. Because of this, this is a pair that I do watch no matter how I feel about actually trading it.

That being said, it does look like we are sitting on support, but the candle does look weak on the whole. While I don't necessarily see a set up in this chart, it does suggest to me that perhaps we are going to enter a "risk off" type of environment again. If we managed to break below the 0.80 handle, this would of course be very bearish.

USD/CAD

The USD/CAD pair had a very strong showing up over the last five sessions, and this is another reason why I feel that "risk off" will be the way going forward this coming week. However, nothing is set in stone and we do have to admit that there is quite a bit of resistance between 0.9950 and parity. Because of this, this is another trade that would be difficult to take, but a daily close above parity should see this pair going to the 1.04 level.

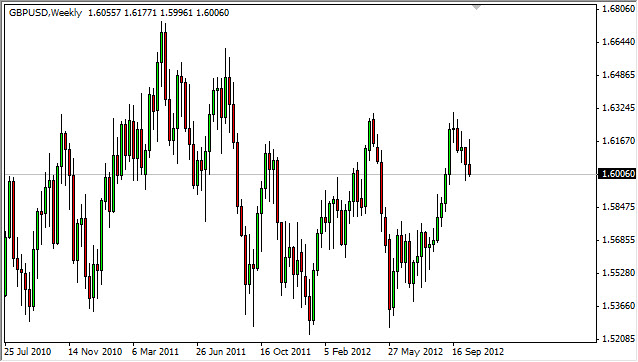

GBP/USD

This pair had a very curious week. It started out very strong, but as the week wore on we managed to form a shooting star. More significantly, we are sitting on top of the 1.60 handle which is massive support as far as I can tell. If this area gives way to the sellers, I believe that the 1.57 level will be targeted eventually. If we get below that, we will go much lower.

AUD/USD

The Australian dollar had a positive week, but the Friday session may look especially vulnerable. Because of this, I do believe that this pair will struggle overall, but it must be said that this pullback is in a fairly look like a meltdown waiting to happen. I think that 1.02 is a reasonable target to the downside in the short-term, but long-term the still looks very much like a currency pair that is consolidating.

EUR/USD

The EUR/USD pair attempted to rally during this previous week, but as you can see above the 1.30 area continues to cause this market trouble. I believe that we are about to see a pullback in this pair, and a move below the 1.28 handle would be the signal that we're going much lower. Even with this significant bounce that we've seen lately, we are still in the massive downtrend and I still see a huge amount of noise between 1.30 and 1.350 or so.