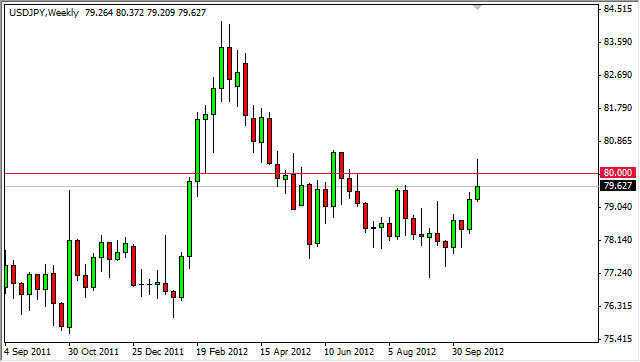

EUR/USD

The EUR/USD pair has been trading in a fairly tight range over the last month, and looks to continue this action. This makes total sense if you think about it, as the Spanish haven’t bothered asking for the bailout that the country certainly needs at this point. Until that happens, there is going to be a certain amount of downward pressure on this pair.

Above the 1.30 level, I see a ton of resistance all the way up to the 1.35 level. This is predicated upon the descending triangle that we formed back in February. Until we get above the 1.35 level, this pair is going to be choppy. However, I do see a move below 1.28 as being an easy sell – if we get it that is.

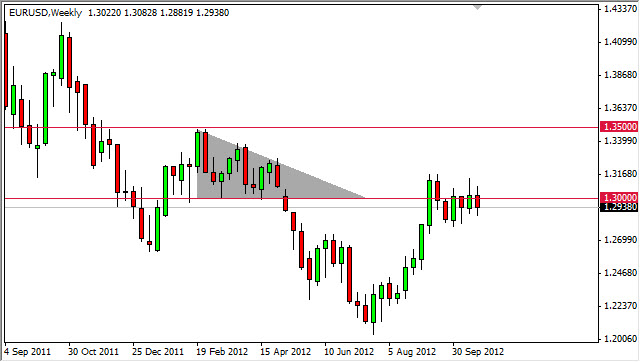

USD/CAD

The USD/CAD could very easily be the most interesting market in the near term. The parity level is a significant one, and if we can get above it we could reenter the previous consolidation area from earlier this year. The area extends all the way to the 1.04 level.

The weekly candle is a hammer, and this suggests that the bulls are coming out in full force. The fact that this candle formed just under the previous support level suggests that we could be going higher. However, if we break the bottom of this candle, it becomes the very negative “hanging man.”

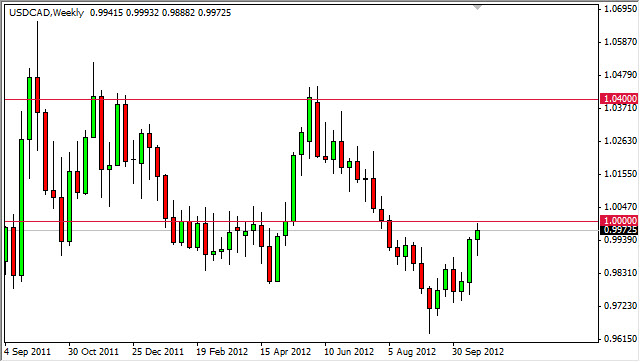

AUD/USD

The AUD/USD pair formed a similar candle to the USD/CAD pair. The area that the pair trades in at the moment is the center or “middle line” of a larger consolidation area, and this could represent an attempt to get back to the top of the rectangle at the 1.06 level. This would of course need a positive sentiment in the markets, which may or may not happen. Overall, I believe that the Australian dollar will be one of the weakest commodity currencies going forward as the Reserve Bank of Australia appears set to cut rates in the near future. Because of this, I have a hard time believing that this pair gets above that 1.06 level, and wouldn’t even be surprised to see weakness in the mean time.

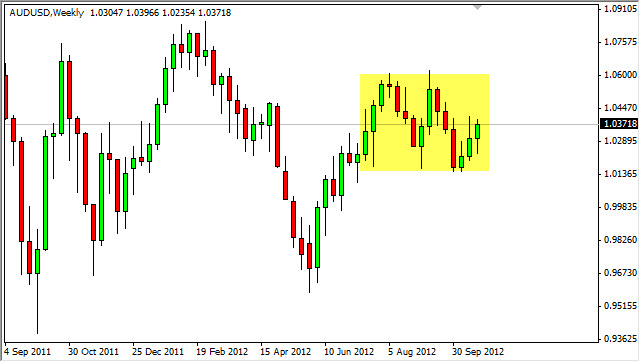

USD/JPY

The USD/JPY pair is being touted as a potential long by a lot of the pundits out there. However, speaking from a purely technical standpoint, this pair looks very vulnerable at the moment. The shooting star that formed at the end of the week showed up at the 80 handle, and this area is more than resistive if you look at the longer-term charts. Because of this, I am willing to short this pair if we get below the bottom the week’s range. I think we would more than likely reach for the bottom of the consolidation, near the 77 handle.