By: DalilyForex.com

GBP/USD

The GBP/USD pair had a volatile week over the last five sessions as we continue to try and find a way through the 1.63 level. I believe that pullbacks in this pair are still buying opportunities, and as long as we are above the 1.60 level I will treat this pair as such.

Ultimately, there is a risk of this pair going below that level, but I believe that the 1.58 level will also be hard for the sellers to overcome. The Bank of England is on hold, while the Federal Reserve will continue to ease as far as the eye can see.

The EUR/USD pair had a very strong showing this past week, closing above the 1.30 level yet again. This pair does look like it's trying to break out and up beyond the 1.35 level eventually, but there is a taunt of noise between here and there. It is because of this that the pair will be one of my least favorite ones going forward in the short term.

I believe that eventually the world will start to focus on Europe again, and this would cause the pair to fall back down. The biggest problem of course is that we don't know when this happens, and as such this pair could be prone to sharp and sudden reversals.

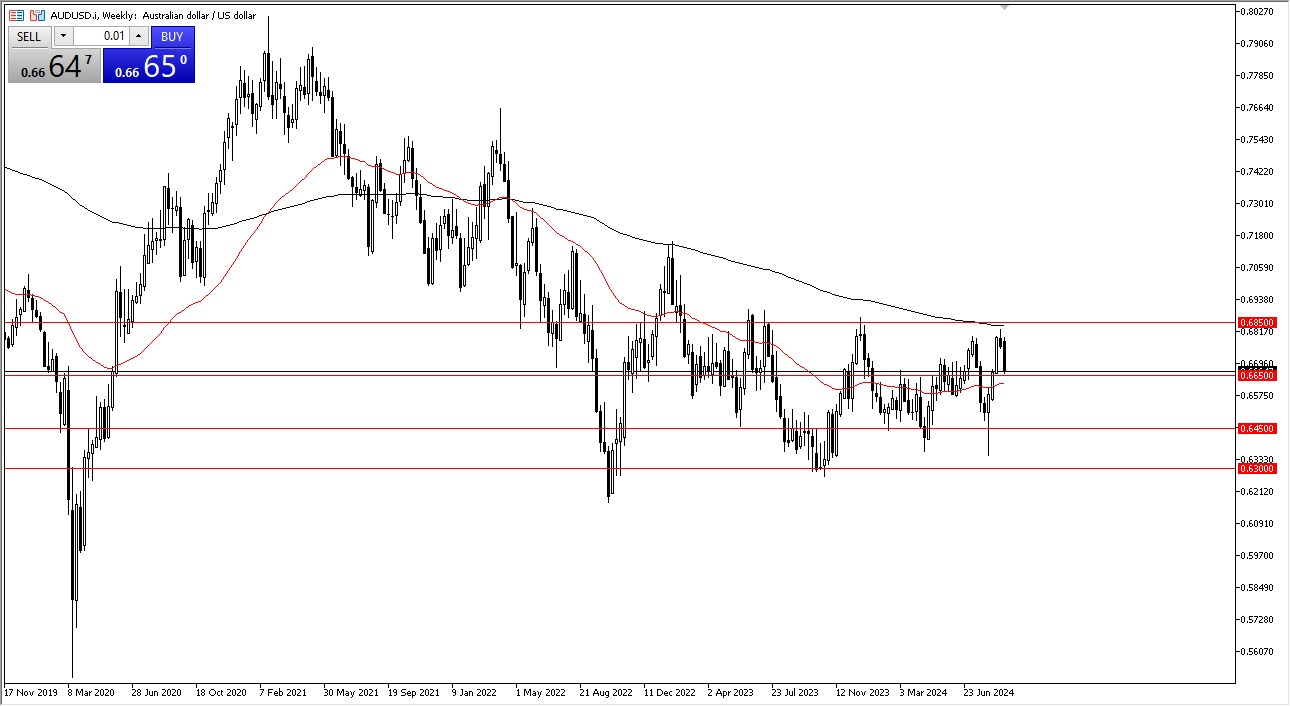

The AUD/USD pair fell during the previous week as the "risk off" trade keeps coming back in style. The Australian economy is suffering at the hands of a Chinese slowdown, and it is believed that the mining boom may have peaked already, if not in the near future. This of course will be bad news for the Australian economy, and as such I believe that the Australian dollar will underperform other commodity currencies in the near-term.

The 1.02 level is a significant support and resistance area, and it did show signs of support at the end of the week. As you can see by the lines on the weekly chart however, if we can get below this area we should see a nice steady move to the 0.97 handle. I personally believe that we will in fact see this move, but a bounce from here first would be a surprise.

The USD/CAD pair fell during the week, but it did find quite a bit of support on Friday in order to push the pair back towards the 0.98 handle. This looks to be somewhat of a confirmation of the hammer from three weeks ago. If we managed to break above the weekly candle that we just printed, I do believe that we will reenter the consolidation area from 0.98 to the 1.04 handle.

With the oil markets looking vulnerable all of the sudden, this in fact is a very likely possibility. The two economies are interconnected, and as such this pair can often be more of a grinder, and less of a runner. I believe that any movement to the upside will be more of the grind a variety and not a sudden one.