By: Andrea Cohen

As you know, on November 6th Americans will vote for President. Democrats and Republicans have different ideas about the central government’s role in the lives of citizens in general and in the economy in particular. We have discussed these differences and the main hurdles and challenges the next administration will face in previous weeks.

To sum things up: Democrats believe in big government, big budgets and a far reach of government into the economy. Republicans see themselves as champions of free markets with minimal regulatory and governmental intervention. Depending on the market conditions at the time of the elections, either side’s ideas and values may be perceived as useful or damaging to the economy. By extension, “good” or bad” for the American economy is also “good” or “bad” for the USD.

Now, if you have a view about how the elections will end and who will win, then in ordinary times, you could have bet in favor or against the Dollar by buying/selling it against other currencies. The problem with this is that most other currencies are also under great uncertainty these days (EUR, GBP and JPY for example) or are just too risky given their dependency on other markets (AUD for example).

This is where Gold comes into the picture. With no “country” to be a weight on its neck, Gold is actually used as a safe-haven asset – one that many turn to in times of volatility and inflation as a safe place to “park wealth”.

The currency pair in question is XAUUSD.

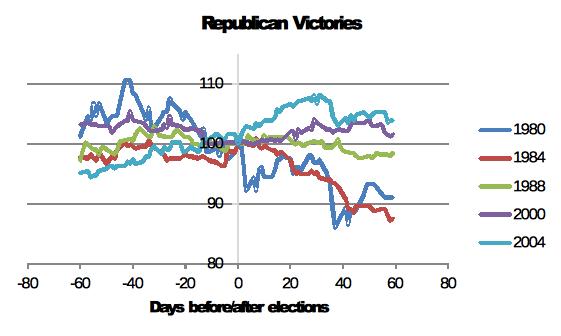

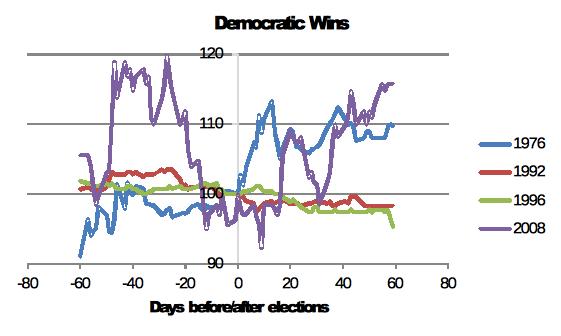

Since 1976, the US had been through nine Presidential elections. Four resulted in Democratic victories and five in Republican victories.

Here are the responses of XAUUSD to the various election outcomes (for the day of election, XAUUSD is normalized to 100):

We see that while Republican wins are followed by an inconsistent behavior of XAUUSD, Democratic wins see XAUUSD going up substantially or staying practically put in the period following the elections.

Therefore, if you predict an Obama victory on November 6th, then you should consider going long XAUUSD to capitalize on that view.