By: DailyForex.com

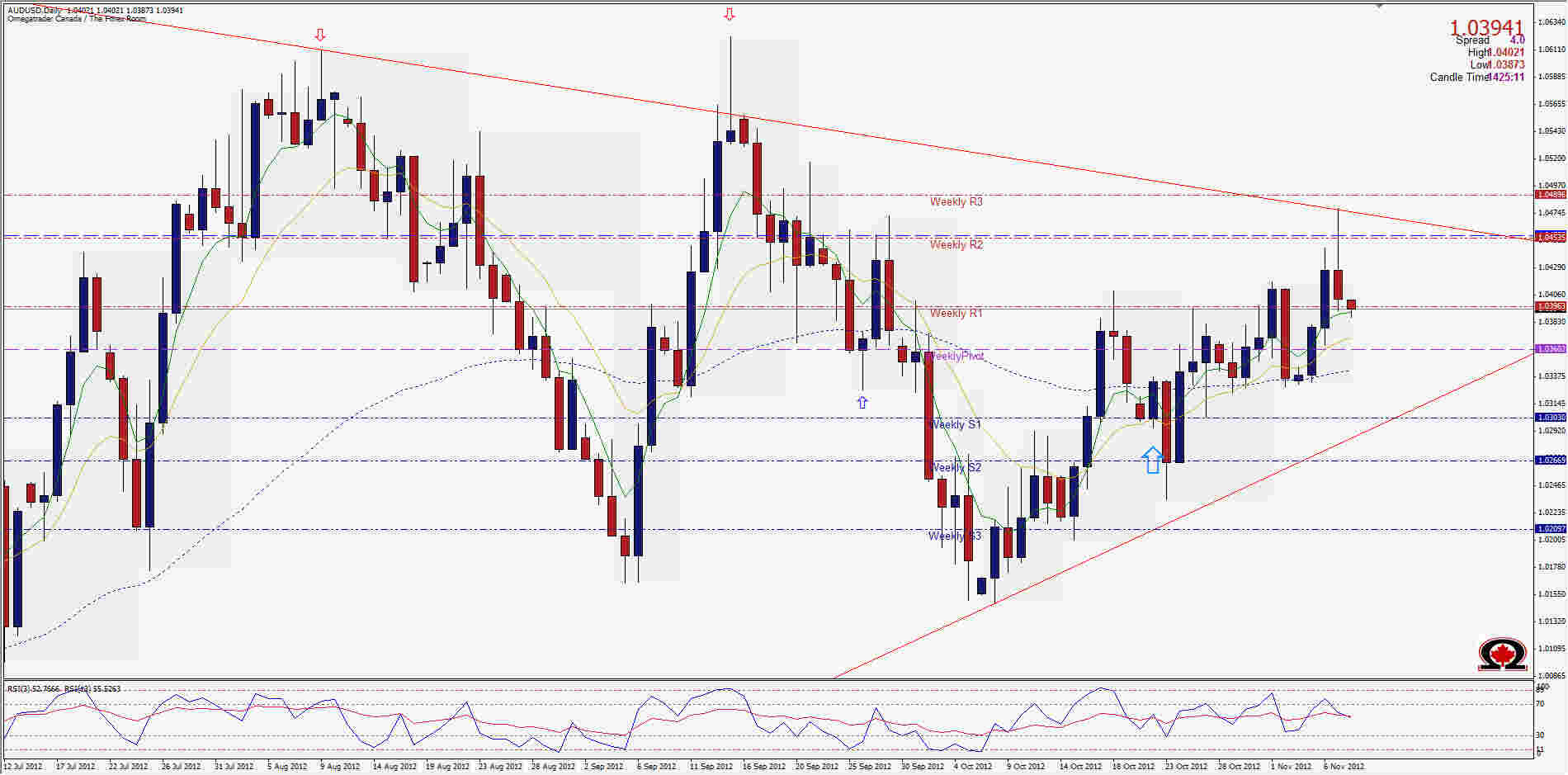

The AUD/USD hit a major form of resistance in yesterdays trading. There is a wedge or pennant formation on the daily chart that is also seen on the Weekly chart with descending and ascending trend lines converging into the easily visible triangle formation known as a pennant.

The descending line was hit yesterday with the Daily High at 1.04796 and then fell to close lower than the open, forming a daily pin bar. Resistance is heavy to the upside with a Weekly R2 at 1.04528, Monthly R1 at 1.04724 and finally the Weekly R3 at 1.04871 all meeting at or near the descending trend line above the current prices. The problem is, support from below is also very strong and this could make travel in either direction a challenge. The Weekly R1 sits at 1.03935 along with the Weekly Pivot at 1.03592 and finally the 62 day moving average at 1.03436. If these support zones can be broken, the bottom of the pennant formation is waiting along with the Weekly S1 at 1.0302. This will be the price to break if the bears want to take prices lower, and if they are successful the yearly low at 0.9581 is not out of the question, but that is a long way off considering the fiscal cliff that awaits the USD in less than 2 months. It is doubtful at this point that the USD will be able to compete with the Aussie until a resolution is reached in the USA over the next 60 days.

Happy Trading!