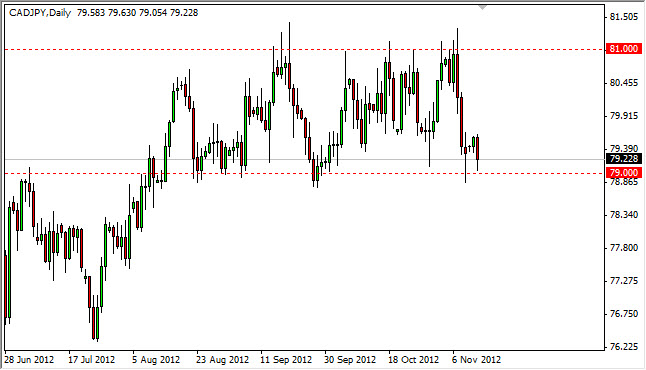

The CAD/JPY pair fell during the session on Tuesday in order to retest the 79 handle for support. This level was marked by a hammer on Friday, as well as many other times where the market has fallen yet found significant support. Because of this, it looks like a decent place to consider buying this pair at.

There will be several crosscurrents going on at once in this currency pair, but suffice to say that the Canadian central bank’s stance is much firmer than the stance seen out of Tokyo. Because of this, it makes sense that the Canadian dollar would continue to appreciate against the Japanese yen.

However, we all know that oil greatly affects the price of the Canadian dollar. In fact, this is one of my favorite currency pairs to trade in relation to the oil markets. With this being said, we have seen a significant softness in the oil markets, so that of course will weigh upon the bullishness of this pair.

Sitting still

Even though the oil markets are working against it, you have to recognize the fact that there is a certain amount of resiliency in this pair. Even with the Japanese importing 100% of their petroleum, this pair hasn't fallen apart as the Canadians haven't needed to export as much. I believe that if we managed to break above the top of the hammer from last Friday, we could see a move right back to the 81 handle.

Alternately, if we managed to break down below the 78.75 level, we could see a significant move lower, which of course would more than likely be accompanied by weakness in the light sweet crude markets as well. It should also be stated that this market is somewhat risk sensitive, and if we get some type of financial meltdown or significant selling off of risk assets, this pair could fall as well during with all this in mind, it is difficult to be overly confident, but based upon the recent trading action I find it more than likely that we are going to continue to grind sideways. With this, and a break of the Friday hammer to the upside, I would be willing to take advantage of it.