The EUR/AUD pair isn’t one that most of you trade, and this is unfortunate. After all, a solid trend isn’t something that we see in the FX markets all the time these days. This pair has a habit of trending, and is much less difficult to trade than a pair like the EUR/USD, one that far too many of you focus on.

The pair has the added bonus of making so much sense. The Europeans are in a recession, and the Australians are the general store for the Asians. As long as there is a fair amount of trade going back and forth across the Pacific, the Australian dollar will have a decent bid to it. Obviously, the Europeans being in recession makes the currency less attractive, and because of this, we have a “clean” trade. The move makes sense, and the trend is clear in my opinion.

Bounce overdone?

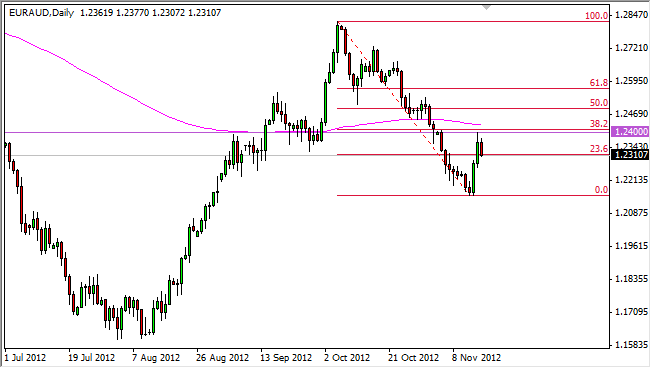

The bounce that we saw earlier this year had a lot of traders thinking that the downtrend was over. After all, the Europeans seemed to be making progress, and the Euro was considered “safe for consumption” again. This caused a massive bounce, but now we see a downtrend forming again.

The pullback over the last couple of weeks has stopped at the 38% Fibonacci level, and the 200 day exponential moving average seems to be acting as resistance at the same time. Also, we should keep an eye on the gold markets as the Aussie is highly correlated to it. With the recent “risk on, risk off” environment being the norm, this pair can be a nice break from that line of thinking.

The pair has a long way to fall by the looks of things, and because of this I see this as a long-term trade. I like the idea of getting the positive swap as well, albeit small, and the trend is undeniable. In fact, there are analysts calling for parity before it is all said and done! None the less, this pair is one you should be paying attention to as a trend is a beautiful thing.