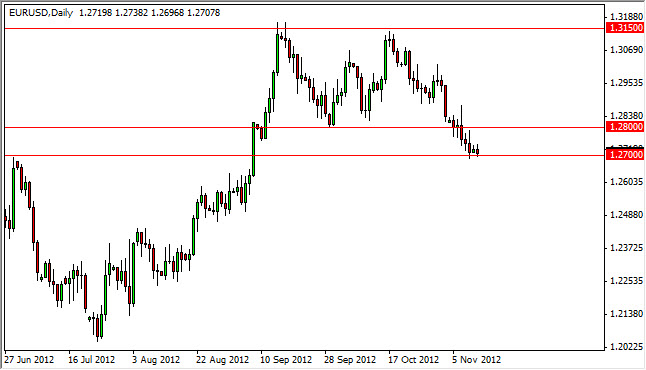

The EUR/USD pair fell during the session on Monday in an otherwise quiet environment. However, I can see that we are sitting on the 1.27 level, an area that has caught my attention. Because of this, I am looking to short this pair if we get below 1.27 on a four hour candle.

The 1.27 level was resistance back in June, and now it offers support. It also looks to me to be the bottom of the support "and" that starts at 1.28 or so. Now that we have gotten to the very bottom of this, and the fact that the daily candle for Monday looks a bit like a shooting star, I do suspect that we will fall.

If we managed to get down below the 1.270 level, I suspect that we will head 21.25 in relatively short order. Where we go from there of course can only be speculated at this point time, but any move below there will more than likely try to find 1.20 handle.

The never-ending issues in Europe

Spanish bond yields are climbing again and this of course shows that people are showing less and less faith in Spain. Spain is a much larger economy than Greece, and let's face it: the Greeks of drag this on for what seems like forever. Can you imagine what it would be like if Spain suddenly found itself at risk of default every few months? This would be an absolute disaster needless to say.

All things being equal, the fact that Germany is slowing down and heading into a recession albeit a mild one is without a doubt one of the most bearish things that I've heard in some time when it comes to the Euro. Because of this, I am very negative of the Euro, even more so than previously. I will be selling this pair if we get substantially below the 1.27 level. I will also be selling on balances going forward as I think we will eventually go much lower. However, I will use relatively tight stops as the “hopium” continues from time to time.