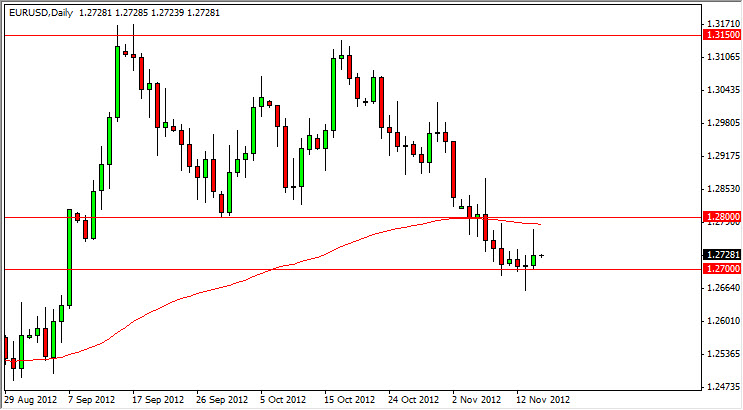

The EUR/USD pair initially rose during the session on Wednesday, but met the 100 day exponential moving average and the 1.28 resistance level and failed. This was predicated upon a speech given by Pres. Obama late in the day that suggested he was not willing to negotiate much when it comes to the US “fiscal cliff.” Unfortunately for him, there is the House of Representatives standing in his way from getting everything he wants. This is leading to a standoff that could cost the United States about 1 1/2% of its GDP next year. In a world that's growing slowly, a recession in the United States would be horrible.

The candle ended up being a shooting star, and as you can see sits just above the 1.27 level. I quite frankly can see any reason to buy the Euro right now, but I certainly couldn't do it until we get well above the 1.28 level as I see it is significant resistance. In other words, I would more than likely need to see a move above 1.2850 to even consider it.

The markets are nervous

In a bit of irony, when the markets get nervous they run to the US dollar. With even more ironic is that even though most of the concerns are coming of the United States, that's exactly where money will run to. Money didn't even bother going into the Treasury market during the session on Wednesday, as it was simply pulled from various risk assets around the world.

Normally, money will run to the Treasury market in order to feel "safe." The fact that traders didn't even bother doing that during the session is a very bad sign indeed. As long as there are concerns about the fiscal situation in the United States and whether or not there could be a grand bargain, there will be massive volatility. Because of this, I believe that one of the few currencies you can own right now is the US dollar. I have no interest in going long of the Euro, and have been bearish for quite some time. All of these reasons and observations don't even take into account the mass that the European Union is presently. With that being said, I would be very interested in shorting this market on a break below the Tuesday range which would show a collapse of the bottom of that hammer.