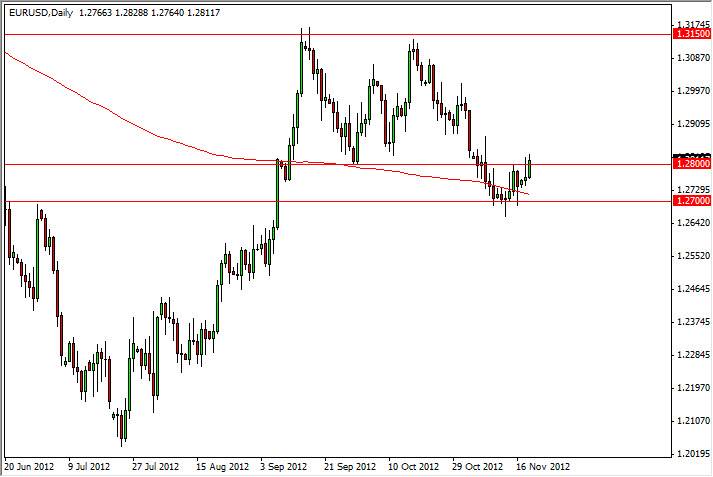

The EUR/USD pair has recently picked up a little bit on the bullish side as the 1.27 level offered enough support to keep the sellers a day. With this being said, it looks like we are attempting to break above the 1.28 handle with some significance, and as such, I believe that a reentry into the former consolidation zone could be about to happen.

I am not a big fan of the Euro as all of you know, but the truth is that the markets will do with the markets will do. If we managed to get above the 1.2850 level, I believe that the Euro will continue to gain against the Dollar. As long as the markets feel like they are in a "risk on" type of environment, this pair should continue higher. I don't find it coincidental that the 200 day simple moving average is right about where we bounced from, and a as such I believe a lot of long-term traders will have paid attention to it. However, we are banging up against pretty significant resistance.

The next three sessions

While I cannot tell you exactly when this will happen, I suspect that over the next three sessions or so we could see a definitive move in this pair. It might be difficult over the next couple of sessions to get significant moves because of a lack of liquidity being Thanksgiving week in America, but the next three normal sessions should see some decision-making going on.

A move below the hammer that sits on the 1.27 level for me since his pair much lower, but that doesn't seem to be the way it wants to act right now. One of the most important things you can do is a trader is to simply get rid of what "should happen" in your mind, instantly follow what is happening. This might be a good example of that, as I find it difficult to own the Euro, but it certainly is been thrown a lifeline at this point. Perhaps, it has to do with the so-called "fiscal cliff" in the United States, but it appears that the market is trying to go much higher. If we do get above that 1.2850 level, we now reenter the 1.28 to 1.3150 consolidation area.