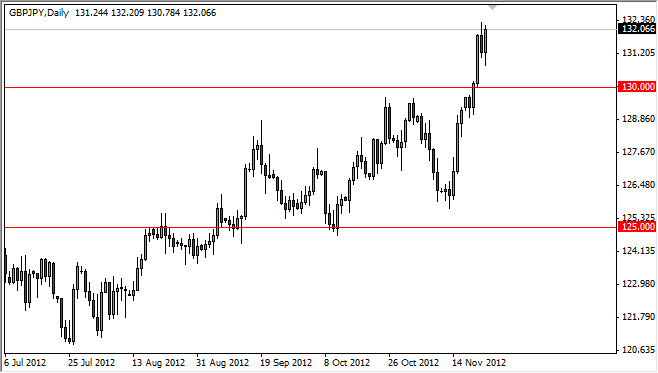

The GBP/JPY pair showed serious strength on Friday as the market almost overcame the shooting star from Thursday. This is a sign that the buyers are still in control, and I do believe that the 130 level will continue to be supportive. After all, we just broke out of a 500 points consolidation area, so it makes sense that we would at least try to match that going forward.

This is a very risk sensitive currency pair, so headlines can and will move it quite rapidly. As long as things are going fairly well, this pair should continue to grind higher. I've noticed that it's somewhat parabolic, but then again all the yen related pairs are at the moment as the Bank of Japan continues to looks set to raise their inflation target to 3%. If that happens, this will devalue the Yen as they print more and more currency going forward.

I like this pair as it does tend to move quite rapidly. When you are correct in this marketplace, and you get rewarded very, very quickly. The 130 level should be the "floor" going forward, and if he gets broken to the downside, I would say all bets are off. This move has been strong, but as you can see we have built a little bit of a base just below the 130 level. This is why I like this trade so much.

Risk on/risk off

For some time, this pair used to be one of the ultimate expressions of whether or not we had a "risk on" type of day, or a "risk off" type of day. I believe we're going to start seeing this relation again as the Yen will continue to artificially weaken as the marketplaces are being manipulated yet again by the Bank of Japan. This is actually the norm for this pair, so not only am I comfortable doing this, I get to enjoy the positive swap at the end of every trading session. There is a reason why these yen related pairs tend to rise over time going back several years, and that was because it was so profitable to start buying them. I think we are about to start seeing that dynamic again. On a break of the highs from the Friday session, I am more than willing to start buying again.