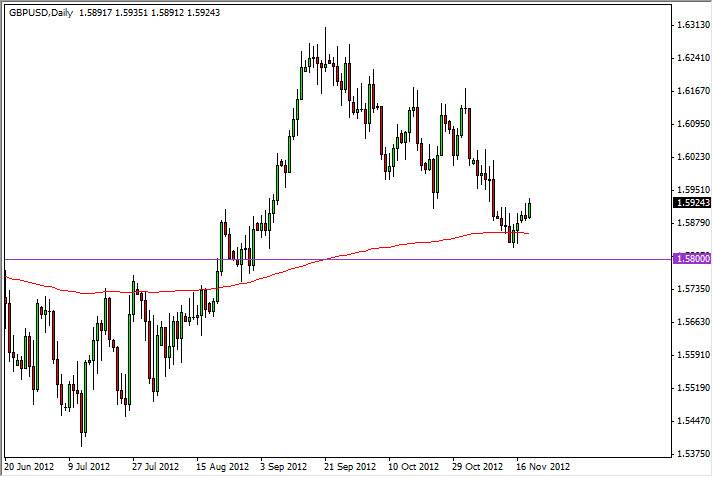

The GBP/USD pair had a strong session during the Tuesday trading hours as we managed to break above the shooting star highs from Monday. This is a very bullish sign, and as such I believe that the British pound is about to start gaining against the US dollar again. I noticed that the 1.58 area held as support, and as long as it does I am still bullish of this pair.

The red line on the chart is the 200 day simple moving average, a moving average that a lot of longer-term traders will follow. Because of this, it makes it obvious that money has moved into the marketplace and started to bid up the Pound. Adding to that the fact that we broke the top of the shooting star, and I am becoming more and more convinced this market will continue to rise.

1.58 is the floor

As long as we are above the 1.58 level, I will not short this market. As a matter fact, I have missed the entire down move simply because I believed in the longer-term set up that we saw this summer come into play. There was an ascending triangle as many of you will remember, and it had a target of 1.63 as we broke out to the upside. We hit that level, and now have retraced about 50% of the original move.

With all this being said, there are plenty of reasons technically that this market should continue higher. I don't necessarily think that it will be a straight shot up, and this is more of a longer-term "grinder" of a trade. However, if you are patient enough you can simply go long of this market and collect your daily swap, which of course adds to the returns that you should gain over time.

We see the 1.59 level is a lot of noise, but in the big scheme of things it is simply a minor area. It is because of this that we would go into the area knowing that it will be a bumpy ride, but one that we should be able to overcome on the bullish side.