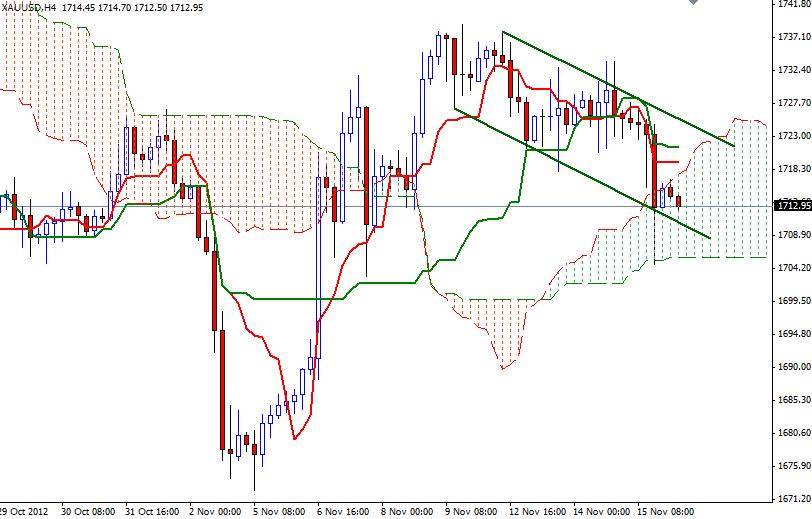

XAU/USD fell sharply after the latest Gold Demand Trends report published by the World Gold Council Thursday revealed that Global gold demand declined 11.0% in the third quarter. Compared to the same period last year, global demand fell from 1,223.5 metric tons to 1,084.6 metric tons, the report said. It seems that lower consumption in China was an important factor in weaker demand. Chinese gold consumption fell from 192.2 tons to 176.8 tons. XAU/USD hit the 1704.80 level, which was the bottom line of the Ichimoku cloud on the 4-hour chart, before retracing back to 1716.30 during the New York session.

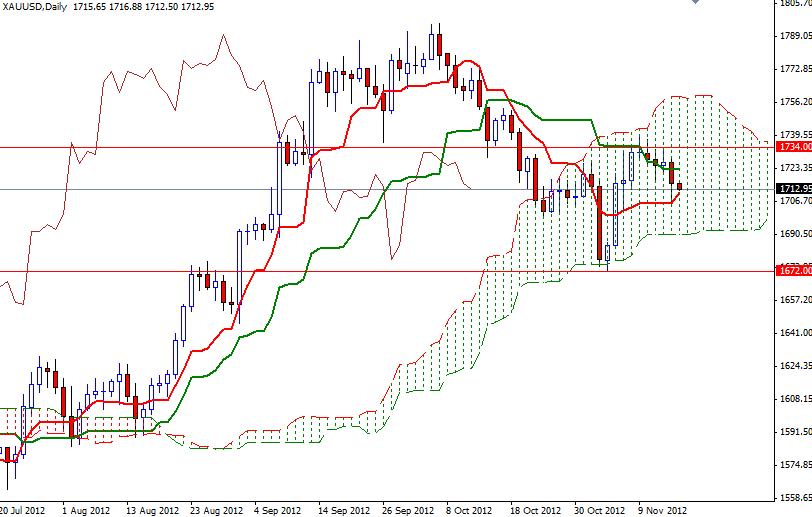

On both charts, Tenkan-sen line (nine-period moving average, red line) / Kijun-sen line (twenty six-day moving average, green line) crosses are pointing towards possible lower prices. The short-term outlook on this pair will definitely remain bearish while trading below the 1720 level, but be cautious as prices are approaching to the bottom line of a descending channel (1710). If we break below this line, I think we will be testing yesterday’s low. A daily close below 1700 would send XAU/USD (gold) much lower. If pair reverses from there, resistance will be found at 1617, 1720 and 1729.