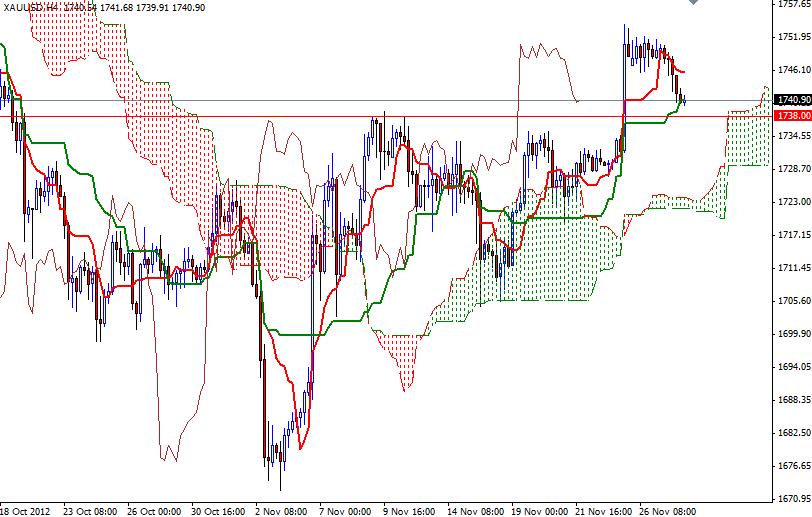

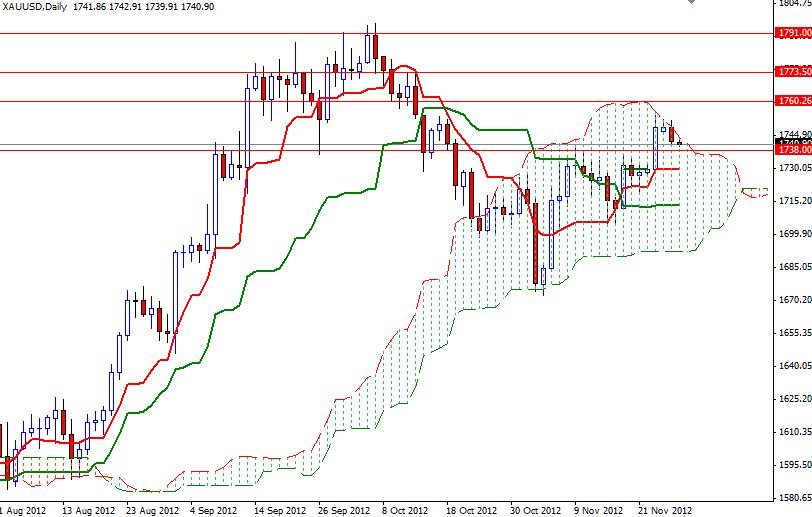

XAU/USD continues to grind lower during the Asian session today. Yesterday the markets turned their attention back to the U.S. data after Eurozone finance ministers and the International Monetary Fund (IMF) reached a deal and paved the way for Greece to receive €44 billion. EU leaders’ inability to solve the debt crisis makes me think that the situation in the peripheral countries will get worse. Disappointing data from the euro region and contagion fear will be contributing to a stronger dollar eventually. On the other side of the Atlantic, investors are focusing on the U.S. fiscal cliff and economic recovery. Yesterday XAU/USD dropped below the 1745 support level on positive U.S. economic data which showed improvement in durable goods orders, the real estate sector and consumer confidence. I think we will test the 1738 support today before the market picks the next move. If XAU/USD successfully breaks below this level, then look for 1733.70, 1729.50 and 1720.27. If the bulls manage to defend this level and the pair turns north, expect to see resistance at 1744.60, 1750.25 and 1754.20. Although high time frames show the uptrend is still valid, short time frames are bearish. If the pair can’t climb above the Ichimoku cloud on the daily chart, I expect to see a drop towards the Tenkan Sen line (nine-period moving average, red line) which currently sits at 1729.50.