Gold prices settled higher yesterday after IMF’s monthly statistics report showed central banks continue to purchase gold as a way of strengthening and diversifying their assets. Without a doubt, the general level of uncertainty in the global economy is contributing to higher gold prices. During the Asian session, gold (XAU/USD) continued to climb and the pair advanced to 1732.54 after a report released by HSBC and Markit showed Chinese manufacturing index signaled the first expansion in 13 months. Since Chinese gold consumption plays an important role in the market, increasing momentum of economic recovery would support gold prices. Markets in the U.S. will be closed due to Thanksgiving holiday; therefore investors’ attention will be on the eurozone PMI figures.

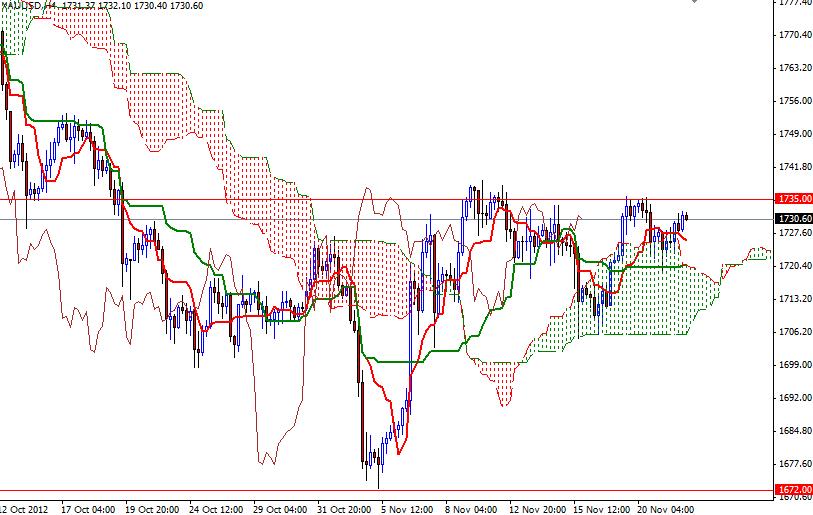

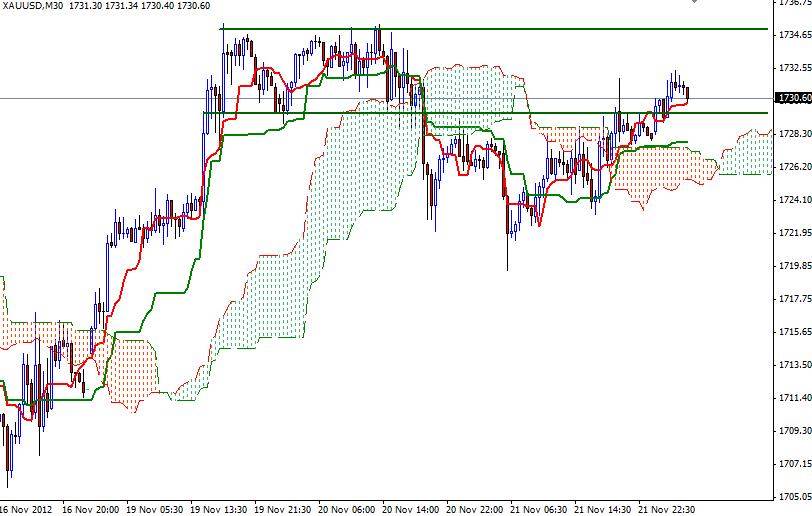

Both 4H and 30M charts are bullish at the moment. Prices are above the Ichimoku clouds and we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses. Pattern on the charts suggests that XAU/USD will be consolidating between 1729 and 1735. Resistance to the upside will be found at 1732.50, 1735 and 1738.90. However, if the bears take over and pull the pair below 1729, look for additional support at 1726, 1720.60 and 1717.