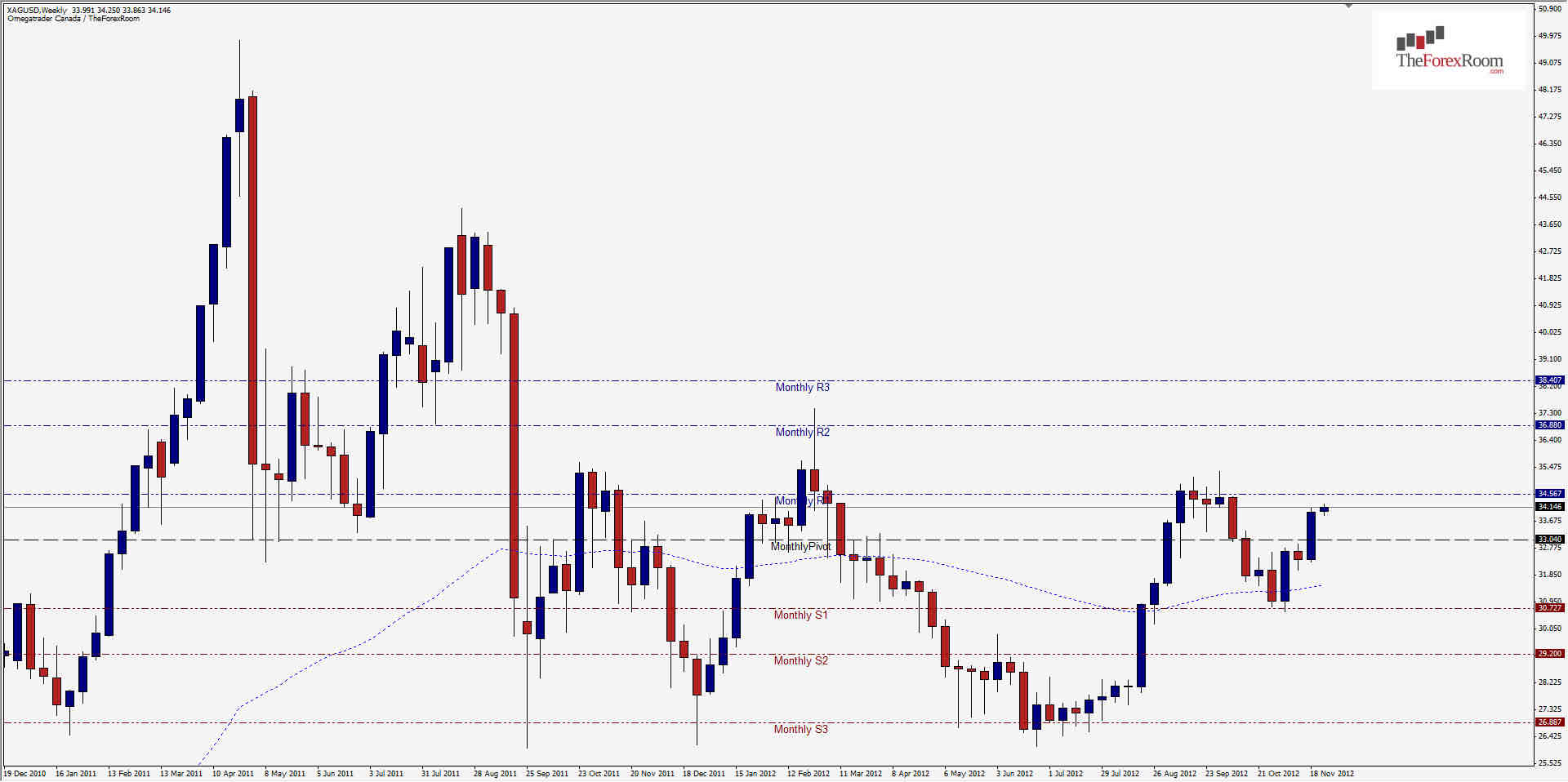

Like its yellow cousin Gold (XAU/USD), Silver (XAG/USD) has been edging higher for the last 3 weeks after falling from a 10 month high in September of 35.38 to a 3 month low of 30.62 earlier this month. The high for 2012 was set at the beginning of the year in February at 37.38 before beginning an 17+ week bearish run to its 2012 low at 26.11, where it spent many weeks between 26.11 and 28.30 before finally breaking higher and breaking a descending trend line that held from April 2011 until August of this year. Now the pair appears to be building bullish strength for a run higher, possibly back to the previous 2012 high or beyond. The pair is long overdue, like Gold, for a bullish run and is considered to be undervalued by most investors. The pair is now trading above the 62 Week EMA at 31.41 and is encountering some resistance at 34.28, 34.62 & 34.75. The next really potent resistance, most recently attacked back in September of this year is at 35.40, a turning point for the pair since early 2011. Support for the pair is equally strong with 33.94, 33.74 & 33.52 being the immediate threats to the bears. This pair should test 35.40 soon, a fail to break will probably result in the bears taking over again.

Silver Slithers Higher- Nov. 27, 2012

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup