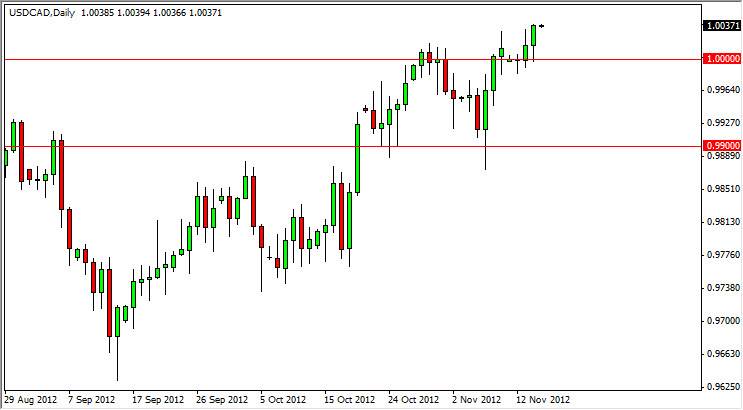

The USD/CAD pair state above the parity level during the Wednesday session even though we saw a spike in the price of oil during the session. This is unusual, as the Canadian dollar normally benefits from higher oil prices. This also sends of all kinds of red flags, as it breaks the norm.

We recently had been flirting around with the parity level, but only on Wednesday did we manage to close strongly above it. We are now reentering the previous consolidation zone in my opinion. This runs all the way up to the 1.04 handle, and as such I think a strong move could be coming.

This of course would make sense, as the US dollar is normally the first thing people buying in times of economic uncertainty. We certainly have plenty of that out there right now, which ironically is coming mainly from the United States. With all that being said, if the United States enters recession because of the fiscal talks breaking down, Canada has the problem of having its largest customer suddenly buying a lot less of its exports. To put things in perspective, Canada exports 85% of its goods and services to the United States.

Going higher

On a break of the session highs from Wednesday, I believe that this pair will continue to grind higher. This pair does have a history of grinding and then suddenly taking off, which is something we could see relatively soon. I was really impressed by the fact that the Canadian dollar could not even rally in the wake of higher oil prices. For me, this was a big tell of what could be coming.

The candle presently is shaped like a hammer, and is sitting on what should be a significant support zone. In fact, I think the support zone goes all the way down to the 0.99 handle, and as such I only have an upward bias at this point time. I do not see a situation where willing to sell this pair, at least until the fiscal talks come to some type of positive conclusion in Washington DC.