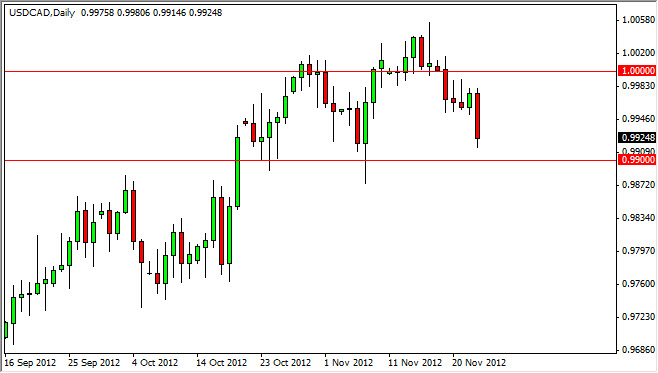

The USD/CAD pair fell during the session on Friday as the consolidation continues between the parity and 0.99 handles. This market looks relatively benign at the moment, and I do see quite a bit of support just below the 0.99 market that would make me think the sellers will have quite a bit of trouble getting below.

The oil markets continue to be the main driver of this pair, and the Middle Eastern troubles continue to be the driver of the oil markets. However, during the recent fighting in the Gaza Strip we haven't seen much of a run to the Canadian dollar. This may be because the Canadian dollar is driven more upon the light sweet crude market spam the bread markets, and as such trouble in the Middle East wouldn't affect Canada quite as much.

Nonetheless, these two economies are very interconnected, and as long as there are concerns about what's going on in the United States as far as the Congress and the fiscal budget is concerned, this can somewhat put a cap on gains made by the Canadian dollar. After all, 85% of all Canadian exports end up in the United States. If the United States suddenly finds itself going into a recession, this is very bad news for Canada.

Two separate traders

For me, I see the 1.0050 level as a trigger to start buying this pair. This would be because of the breaking of the shooting star that started the latest down leg, and would show that momentum is picking back up to the upside. Alternately, I believe that if we managed to break down below the 0.9880 level, we could see a serious run into the Canadian dollar. This will require a "risk on" type of marketplace, as all "risky" assets would have to be showing positive sentiment out there. In order to get a feel for that, keep an eye on the oil markets, but also many of the other commodity markets. Stock exchanges around the world should be rising, and if they are not, then you can realize that something isn't quite right.