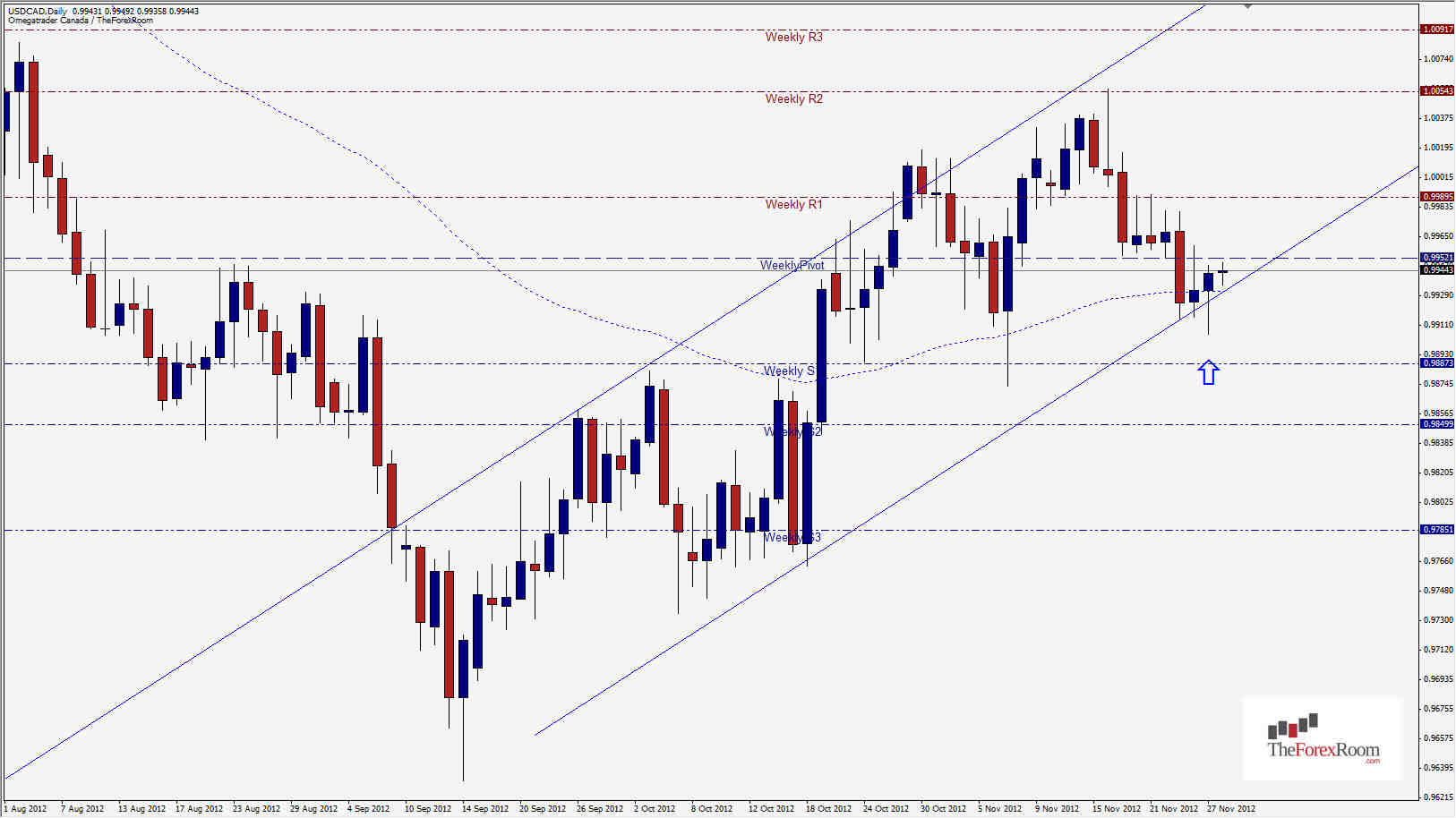

The Loonie (USD/CAD) appears to be respecting a bullish channel that has formed since the pair hit an almost 2 year low on September 14 of this year at 0.9632. After setting the low the pair moved higher in a zig-zag pattern over the weeks that followed and after testing the 5 month high at 1.0056 (Also the Yearly 50% FIBO) 12 days ago it has retraced to the current level of 0.99458. The pair printed a Bullish Pin Bar off of the lower edge of the ascending channel, which also happens to line up with a Weekly zone of support at 0.9925. This is a zone that has reversed, or at least give the pair pause many times over the past few years, and is an excellent level to consider taking longs on the pair. The Weekly Pivot sits directly above at 0.9952, but once clear of that, parity is in sight once again, and the Weekly R1 at 0.9989 offers resistance on the way up. The pair will likely retest the top of the channel and the 2 week high/Weekly R2 beyond that at 1.00543. Finally the top of the channel lines up perfectly with the Weekly R3 and will be the last bastion of resistance before a technical vacuum appears which could pull the pair all the way up to the 62 Month EMA at 1.0523. If the channel is broken by the bears however, look for the pair to descend rapidly to 0.9880 area and 0.9850 below that. In the big picture, a break of 0.9785 will signal a bearish run to at least 0.9632 again.

USD/CAD Respects Bullish Channel

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- AUD/JPY